Blockchain technology has driven major innovations in finance and asset management. Blockchain protocols are tokenizing Real World Assets (RWAs) physical assets like real estate, commodities, art, and intellectual property making them more liquid and tradable. As these protocols improve, they help convert these assets into digital forms, increasing accessibility.

This blog explores the key protocols of Real World Assets 3643, which enable tokenization for decentralized trading and use in DeFi ecosystems. Understanding these protocols is crucial for investors, developers, and blockchain enthusiasts to unlock the future of digital asset markets.

What Are Real World Assets (RWAs)?

RWAs are physical assets that blockchain can convert into digital tokens.These assets include:

- Real Estate: Tokenizing real estate allows for fractional ownership or investment.

- Commodities: Assets like gold, oil, and agricultural products.

- Art and Collectibles: Unique assets like paintings, sculptures, and rare items.

- Intellectual Property: Patents, trademarks, and copyrights that can be represented digitally.

Tokenizing these assets increases liquidity, tradability, and manageability, creating new investment opportunities and opening access to wealth-building assets. The potential to profit from RWAs depends on blockchain protocols that ensure security, transparency, and efficient tokenization.

Protocols Behind Real World Assets 3643: The Technical Foundation

Protocol 3643 enables RWAs to integrate with blockchain networks. Let’s explore the key protocols involved in RWA operations.

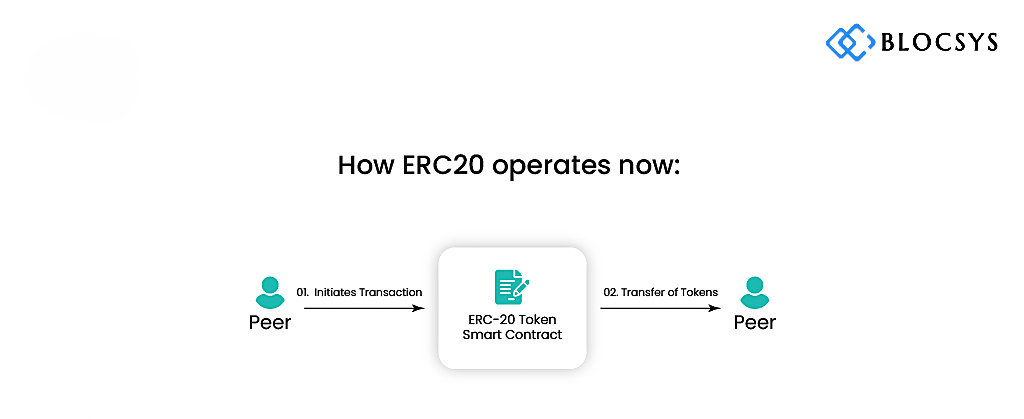

1. ERC-20 Protocol: Tokenizing Fungible Assets

The ERC-20 protocol commonly defines fungible tokens on the Ethereum network. By enabling the creation of fungible assets represented as tokens, each token holds the same value as another of the same type.

- Use Case: ERC-20 is ideal for tokenizing assets like commodities (gold, oil), stocks, and bonds, where each token can be exchanged equally.

- Benefits: ERC-20 tokens benefit from Ethereum’s strong security, decentralization, and liquidity, making them a preferred choice for asset tokenization.

2. ERC-721 Protocol: Tokenizing Non-Fungible Assets (NFTs)

However ERC-20, the ERC-721 protocol creates non-fungible tokens (NFTs), each representing unique, irreplaceable assets like real estate, artwork, or intellectual property. Each token is distinct, offering secure, verifiable ownership.

- Use Case: ERC-721 is ideal for tokenizing unique assets such as art, property, and collectibles where each item has individual value.

- Benefits: ERC-721 enables fractional ownership of unique assets, allowing smaller investors to own a portion of valuable items like real estate.

3.ERC-1400 is a standard for security tokens

ERC – 1400 is a standard for security tokens on the Ehtereum blockchain designed to address the needs of the security token industry. It combines the best features of other token standards, such as ERC-20 (for fungible tokens) and ERC-721 (for non-fungible tokens), while adding additional functionality required for compliant security tokens.

Key features of ERC-1400 include:

- Divisible and Tradable: It allows for fractional ownership, making it easier to trade and transfer shares of an asset.

- Compliance: It enables compliance with regulatory requirements, allowing issuers to integrate features like KYC (Know Your Customer) and AML (Anti-Money Laundering) checks into token transfers.

- Security: It ensures that the transfer of security tokens follows proper legal and regulatory protocols, preventing unauthorized transactions.

ERC-1400 is used primarily for tokenizing traditional financial assets like equity, debt, real estate, and other securities in a way that ensures compliance with applicable laws and regulations.

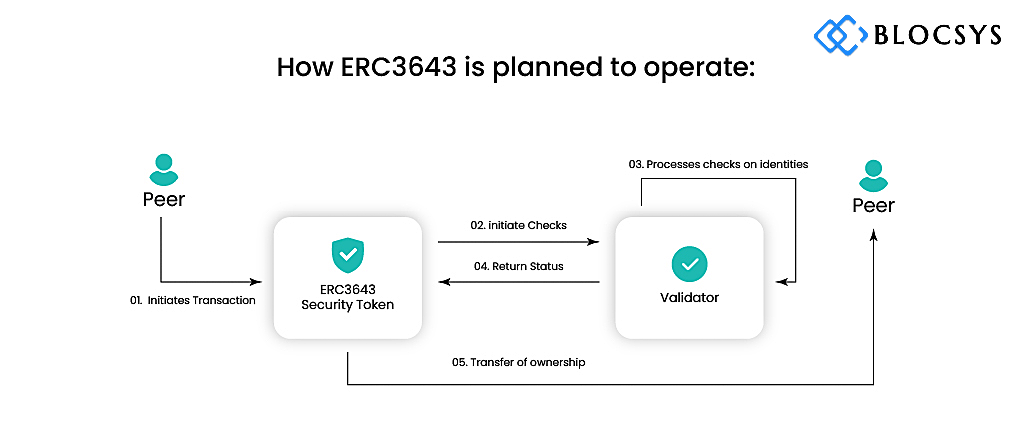

4. ERC – 3643

ERC-3643 is a proposed token standard for Real World Assets (RWAs) on the Ethereum blockchain. Its primary goal is to create a framework for tokenizing real-world assets, such as real estate, commodities, and other tangible assets, in a way that ensures regulatory compliance and enables the seamless exchange of these assets in decentralized finance (DeFi) ecosystems.

Key Features of ERC-3643

1.Regulatory Compliance:

- ERC-3643 is designed with compliance in mind, allowing issuers to embed regulations directly into the token’s smart contract. This helps ensure that tokenized real-world assets adhere to legal requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) standards.

2.Tokenization of RWAs:

- It enables the creation of digital tokens representing ownership of physical assets, enhancing liquidity and making it easier to trade real-world assets on blockchain platforms.

3.Interoperability:

- ERC-3643 ensures that tokens representing real-world assets can interact with other ERC standards and decentralized applications (dApps), making it easier for asset owners and investors to engage with the wider DeFi ecosystem.

Benefits of Using Real World Assets 3643 Protocols

- 1. Increased Liquidity

- Tokenization opens markets for traditionally illiquid assets, like real estate and collectibles, to a broader range of investors. Fractional ownership allows smaller investors to participate.

- 2. Enhanced Accessibility

- RWAs protocols give investors access to global markets previously limited by geographic or regulatory barriers.

- 3. Improved Transparency

- Blockchain records every transaction involving tokenized assets on an immutable ledger, guaranteeing transparency and security.

- 4. Lower Transaction Costs

- Blockchain eliminates intermediaries, reducing costs associated with buying, selling, or transferring assets, providing a cost-effective way to manage investments.

The Future of Real World Assets and Blockchain Protocols

As blockchain technology progresses, it will continue to integrate RWAs into decentralized networks, transforming industries such as real estate and finance. The protocols of Real World Assets will play a crucial role in tokenizing various physical assets, opening new investment opportunities and promoting financial inclusion.

The next step for RWAs is likely to involve more advanced protocols, better scalability solutions, and greater integration with traditional financial systems. As regulations evolve to accommodate digital assets, RWAs will become a driving force in the future of finance.

Conclusion

The protocols of Real World Assets represent an exciting future for tokenized finance. Using such protocols like ERC-20, ERC-721, and robust oracles such as Chainlink, RWAs are reshaping how we invest in and manage real-world assets. They are making digital asset markets more liquid and accessible while also improving market security and transparency. As blockchain continues to expand, RWAs have vast potential to transform industries, creating a more inclusive, efficient, and transparent financial future.Copy

SEO Keywords:

- Real World Assets (RWAs)

- Real World Assets 3643

- Blockchain protocols

- Asset tokenization

- ERC-20, ERC-721, ERC-1400

- Tokenized real estate

- DeFi and RWAs

- Security tokens