Stablecoins are now the backbone of digital finance, with the financial world entering a new phase. The. Stable coins are not like volatile cryptocurrencies like Bitcoin and Ethereum as they are designed to maintain a fixed value, typically linked to fiat currencies such as the U.S dollar or the euro. The speed and transparency of blockchain technology make them a valuable addition to real-world business applications, thanks to their stability.

Fixed coins are addressing the long-standing inefficiencies in global finance, such as cross-border payments, payroll for remote teams and B2B settlements, and corporate treasury management. To startups, investors and enterprises, they are not just a financial innovation; they’re also an instrument with which to strategically cut costs, increase liquidity through the supply chain, then expand abroad. Why?

This blog will provide insight into the emergence of stable coins, their significant advantages, the obstacles they face, as well as their potential role in digital finance. Read on to find out more. Furthermore, we’ll explore the use of blockchain-based solutions to harness stable coins and increase competition in a fast-paced economy.

What is a stablecoins?

A stablecoin is a digital token that seeks to maintain price stability. The. Stablecoins maintain a steady value for users and applications, unlike Bitcoin and other altcoins, and function as reliable value-storing assets in the crypto ecosystem

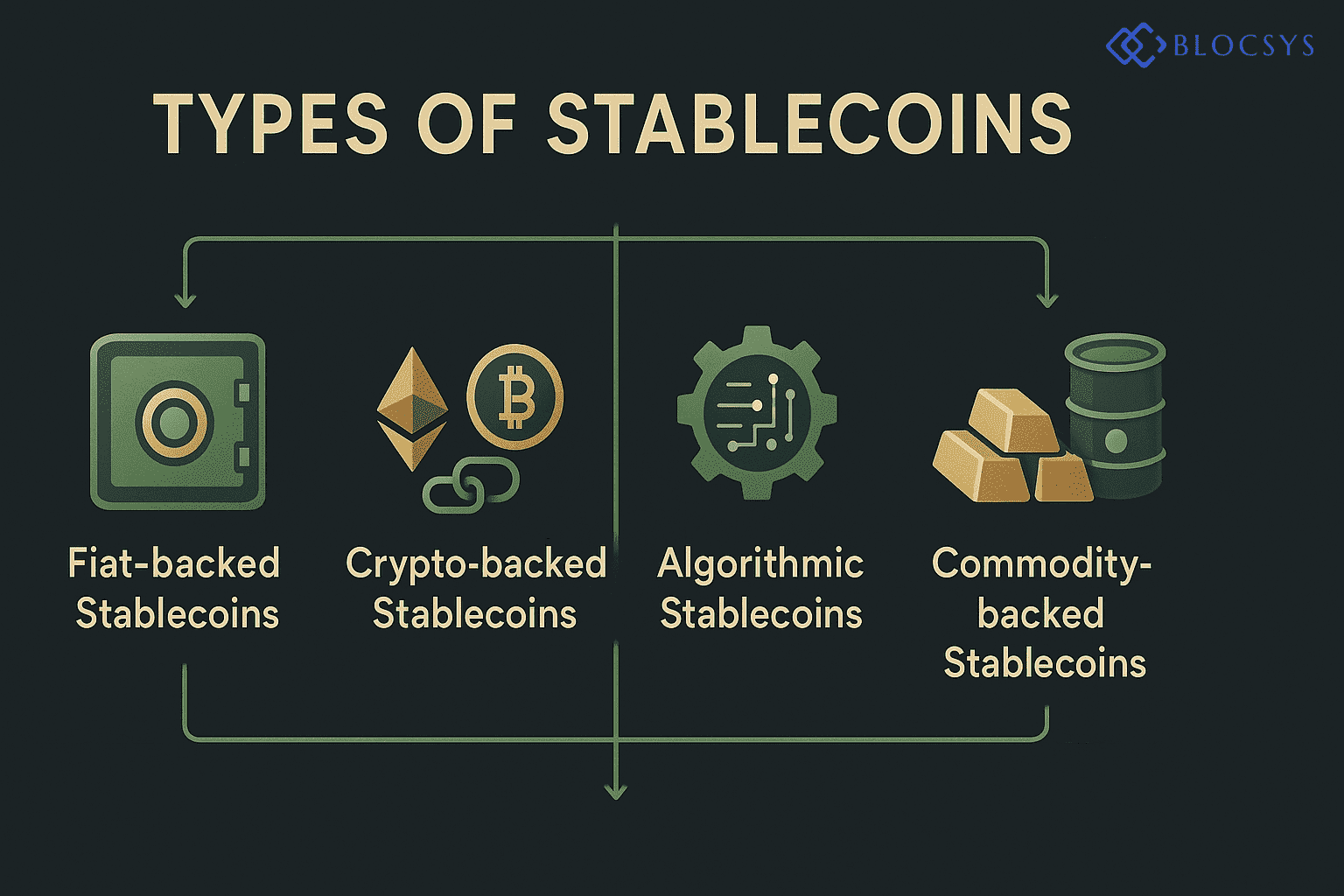

Types of Stable Coins

1.Fiat-Collateralized Stable Coins

- Fiat reserves (e.g, USD, EUR) held by a custodian are used to provide 1:1 support for these assets. Each token is a claim to the fiat held in underlying banks or trusts.This model is straightforward and provides strong price stability provided the issuer is transparent and reserves are auditable.

- Various examples include USDT (Tether) and USDC (USD Coin).Crypto-Collateralized Stable Coins.

2.Crypto-Collateralized Stable Coins

- Over-collateralized with crypto assets to ensure stability.

- Example: DAI by MakerDAO.

3.Algorithmic Stable Coins

- Keeping prices stable through code-based monetary policy, the allocation of algorithmic stablecoins is achieved by expanding or contracting the supply through protocol rules.

- Use mechanisms that manage both demand and supply.

4.Commodity-backed stablecoins

- The stability of these stablecoins is derived from the underlying commodity and is linked to tangible assets like gold or oil. Commodity market prices and storage/custody arrangements are the determining factors for their value.

Why StableCoins Are Transforming Business

Stablecoins serve as a bridge between conventional finance and blockchain-driven innovation. Financial systems are enhanced by operational tools that go beyond digital tokens.

Key Benefits

- Faster Payments – With help of stablecoins Cross-border transactions are able to be processed in seconds, not in days.

- Lower Fees – Sablecoins reduced banking and remittance costs.

- 24/7 Access – No waiting for bank hours or holidays.

- Transparency – Transactions recorded on blockchain for easy auditing.

- Reduced Risk – Stable prices unlike volatile cryptocurrencies.

- Treasury Flexibility – Businesses can hold liquid reserves in digital form.

According to EY, 54% of financial institutions plan to integrate stable coins by 2026, with cross-border payment savings exceeding 10% for early adopters.

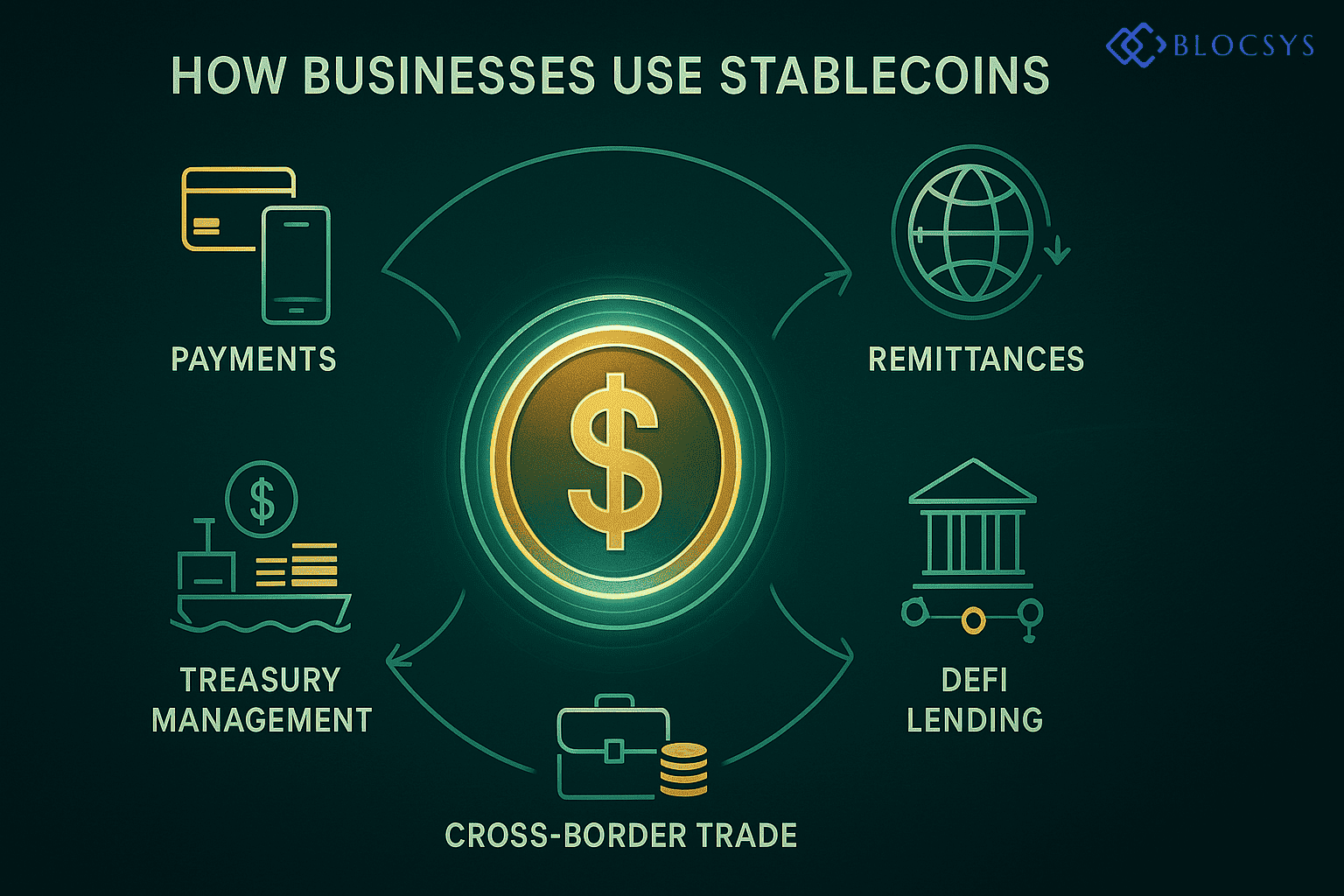

Business Use Cases of StableCoins

Stable coins are already transforming corporate finance.

- Cross-Border Payments

Instead of waiting 2–5 days for a SWIFT transfer, many companies are using stable coins for cross border settlement. - Payroll & Remittances

Remote teams and gig workers can be paid in stable coins, avoiding delays and high remittance fees that usually happen in the SWIFT payment system. - B2B Transactions & Supply Chains

Import/export businesses use stable coins to settle invoices, hedge against FX volatility, and speed up international settlements. - Corporate Treasury

Treasury teams of many companies nowadays hold stable coins for liquidity, hedging, and yield-generation opportunities in digital finance and for faster settlement. - Smart Contracts & Automation

This can be used to power automated escrow services, recurring subscriptions, and milestone-based payouts via blockchain smart contracts.

It is estimated that by 2030, stable coins could handle 5–10% of all cross-border payments, that’s $2.1– $4.2 trillion annually.

Stable Coins vs. Fiat vs. CBDCs

| Feature | Stable Coins | Traditional Fiat | CBDCs |

| Settlement Speed | Seconds | 1–3 days | Instant (when live) |

| Transaction Costs | Low | High (SWIFT, wires) | Low |

| Availability | 24/7 | Bank hours only | 24/7 |

| Programmability | High (smart contracts) | None | Limited |

| Control | Private issuers | Central banks | Central banks |

Stablecoins are already widely used. CBDCs are still in development, and fiat remains limited by traditional banking rails.

How Businesses Can Leverage StableCoins

Adopting stablecoins requires more than just holding digital tokens. Businesses need secure, compliant, and tailored blockchain solutions provider.With the right technical partner, startups and corporates can integrate stable coins safely, cut costs, expand globally, and future-proof their financial systems.Blocsys leads the stablecoin race as your one-stop destination delivering secure, compliant, and scalable stablecoin infrastructure that empowers your businesses to move, settle, and innovate with confidence along with faster speed in the market.

How Blocsys Technologies Can Help

A blockchain technology partner like Blocsys technologies offers services to make stable coin adoption seamless:

- Custom StableCoin Development

Design fiat-backed or crypto-backed stable coins tailored to business needs. - Wallet & Exchange Integration

Build secure apps and exchange platforms for stable coin storage and transfers. - Smart Contract Automation

Enable escrow, automated payroll, supply chain payments, or subscription models. - Compliance & Security

Implement KYC/AML modules, auditing, and regulatory frameworks to stay compliant. - Real-World Asset Tokenization

Tie stable coins to real assets (e.g., real estate, gold, or commodities). - Blockchain Consulting & Strategy

Provide end-to-end blockchain development for startups and enterprises adopting stable coins.

Conclusion

Stable monetary bills are not the latest innovation in cryptography, but rather the foundation of the upcoming financial system.'”. By utilizing blockchain, they can enhance the stability of fiat currencies and increase transparency in global transactions.

Stable coins offer a fresh avenue for investment for VCs, founders and investors. CIn a digital-first world, companies can save money, expand worldwide and maintain their competitive edge with help of the stable coin .

Expert blockchain partners like Blocsys technologies can help companies implement stable coins in a safe, compliant and customized way without having to navigate this shift alone.

Frequently Asked Questions

1.Could you describe stablecoins and their significance?

Ans.Stablecoins typically link to fiat currencies like the U.S. dollar or the euro, which allows them to maintain a fixed value as cryptocurrencies. By the combinations of both Traditional currency’s stability and blockchain’ s efficiency make them essential for cross-border payments, business transactions, or digital finance. This is why they’re important.

2.How do stablecoin differ from Bitcoin? Please explain.

Ans.Digital assets such as Bitcoin and Ethereum are not suitable for everyday transactions due to their instability. Why? The stability of hard coins makes them a perfect fit for handling payroll and B2B payments, as well as corporate treasury management.

3.Is it safe to use stablecoin for business operations?

Ans.Businesses can ensure the security of stable coins by opting for regulated, audited and fully collateralized counterparts like USDC or euro-backed tokens. This is advantageous. Despite the risk of algorithmic stable coins (such as TerraUSD that collapsed in 2008), regulators across multiple countries have increasingly recognized that compliance-oriented stable coin systems are prevalent.

4.What are the primary business applications of stablecoins?

Ans.The top use cases include:

- Cross-border payments with no late fees or delays.

- Payroll for remote teams.

- B2B supply chain settlements.

- Corporate treasury reserves.

- Smart contract automation.

In these use cases, stable coins make them especially attractive to startups and businesses as well as investors.

5.What is the mechanism for managing stablecoins in the US, UK and Europe?

Ans. The GENIUS Act of 2025 in the United States clarifies the rules for dollar-backed stable coins.

- The FCA enforces strict compliance for stable coin issuers in the United Kingdom.

- European banks, in collaboration with Germany, will introduce euro-backed stable coins, and regulators will oversee and launch them soon.

- While regulation is changing, there appears to be a greater tendency towards adoption and transparency.

6.How do you see the future of stablecoins in the global finance?

Ans.Stable coins are anticipated to manage payments of approximately 2.4 trillion US dollars annually by 2030. They will coexist with central bank digital currencies (CBDCs), integrate with DeFi and tokenized assets, and expand into emerging markets where inflation drives demand for digital currency.