The voluntary carbon market (VCM) is at a tipping point, and carbon tokenization is emerging as a critical infrastructure upgrade rather than a passing trend. High-integrity carbon projects are emerging and gaining verification faster than ever, yet the market infrastructure around them still feels outdated. Most Web2 carbon ecosystems excel at project development and certification, yet they continue to face structural bottlenecks: limited liquidity, fragmented access, slow settlement cycles, and inconsistent transparency across the lifecycle of a credit.

This is where carbon tokenization becomes a real market upgrade not a trend.

By representing verified carbon credits as digital, traceable assets, tokenization introduces a new operating layer for carbon markets: one that improves market accessibility, enables real-time auditability, and supports programmable carbon finance (from fractional ownership to automated retirement and reporting). The goal is not to replace registries or existing standards, but to extend them with modern rails for trading, financing, and verified retirement.

For startups, this shift opens an entirely new category of platforms: carbon tokenization and trading infrastructure, MRV-enabled marketplaces, compliance-first trading venues, and ReFi primitives. For Web2 carbon projects, tokenization offers a scalable path to broader demand, faster liquidity, and enterprise-grade trust without changing the core environmental mission.

In this blog, we break down how carbon tokenization works, the market opportunities it unlocks, and the key design principles shaping the next generation of climate-focused financial infrastructure.

What is Carbon Tokenization?

Carbon tokenization takes verified carbon credits like those from Verra, Gold Standard, or Puro.earth. It turns them into digital tokens on blockchains such as Polygon, Solana, or Base. Each token stands for one tonne of CO2e. It has a clear and unchangeable history. Automated smart contract retirement processes prevent double-spending.

Typically, this process employs ERC-20 tokens for fungible credits. It uses ERC-3643 for specific project batches that come with unique metadata. Or it creates specialized NFTs for high-impact projects. This digital shift guarantees transparency. Every credit’s journey from issuance to retirement stays recorded on an immutable ledger.

Why Web2 Carbon Projects Should Engage with Tokenization

For the current Web2 carbon projects, tokenization isn’t something to fear. It’s actually a fantastic opportunity for growth and making a real difference.

- Enhanced Liquidity & Access: By breaking down large batches of credits into smaller, more tradable units, tokenization opens the door to a broader range of buyers. This could boost demand and help stabilize prices.

- Improved Transparency & Trust: Thanks to blockchain’s unchangeable ledger, we can verify credit origin, ownership, and retirement in real-time and publicly.

- Tokenized carbon offsets can integrate directly into Decentralized Finance (DeFi) protocols, unlocking innovative finance opportunities. This means projects can tap into options like carbon-backed lending or liquidity pools to secure upfront funding for their development.

- Streamlined Efficiency: Smart contracts handle sales, retirement, and royalty distribution. This cuts administrative work. It also reduces transaction costs.

Carbon Tokenization Platforms: Blueprint for Startups

For startups eager to make their mark in the carbon trading arena, the real opportunity lies in developing strong carbon trading platforms.

These platforms go beyond mere exchanges; they serve as the essential backbone of the industry.

Key components for a successful platform include:

- Robust Bridging Methodology: A legally sound and technically secure approach to tokenizing credits from major registries. This is what builds trust.

- Integrated Digital MRV: uses IoT, satellite data, and AI. It delivers verifiable, near-real-time insights on carbon sequestration or reduction. This moves past old-school manual verification methods.

- User-Centric Marketplace: An easy-to-navigate interface for both institutional buyers (like corporations) and individual participants. Features should include portfolio tracking, impact analytics, and hassle-free retirement proofs.

- Interoperability & Compliance: Crafting the platform to work seamlessly with others. It must meet ever-changing international standards. These include the [Article 6 rulebook]. It also covers corporate reporting frameworks like SBTi.

Carbon Tokenization: Regulatory Roadmap 2026

The voluntary carbon market is currently experiencing a swift move towards standardization. For builders and participants, maintaining integrity is absolutely essential.

- Core Carbon Principles (CCP): Make sure your platform offerings align with benchmarks like the ICVCM’s CCPs to guarantee quality.

- Article 6 Readiness: Create systems that are flexible enough. They must handle approvals from sovereign authorities. These systems need necessary adjustments. Adjustments come under the Paris Agreement.

- Guard Against Greenwashing: Conduct thorough due diligence on projects you onboard.Communicate clearly that carbon offsets should enhance decarbonization strategies. They should not replace a company’s main decarbonization strategies.

Carbon Tokenization: Fractional Ownership & ReFi

Tokenization opens up possibilities that traditional systems simply can’t offer.

- Fractional Ownership: This concept lets everyday people invest in large-scale, impactful projects that were once only available to big corporations.

- Programmable Carbon: With smart contracts, we can automate intricate transactions. Picture a crypto wallet. It automatically retires carbon tokens. This balances out gas fees for transactions. Or picture a supply chain contract. It retires tokens immediately. This occurs as soon as we deliver the shipments.

- Composability: Tokenized carbon offsets serve as essential components.They fit in a larger ecosystem of [regenerative finance (ReFi)].

Compliance Token Minting (ERC-3643)

Instead of general token standards, ERC-3643 tokenizes carbon credits as compliance-ready assets.

- We mint credits with structured metadata (vintage, methodology, location, co-benefits).

- The system restricts transfers so that only eligible participants can hold or trade credits.

- Built-in policy controls support institutional requirements and reporting

- This makes ERC-3643 ideal for enterprise carbon markets where eligibility and auditability are critical.

What Stays On-Chain vs Off-Chain in Carbon Tokenization

A well-designed carbon tokenization architecture balances transparency with scalability and regulatory compliance. Not all data needs to live on-chain and forcing everything onto a blockchain can introduce unnecessary cost, latency, and legal risk. The key is intentional separation of concerns.

What Stays On-Chain

We store on-chain only the data that benefits from immutability, auditability, and public verifiability:

- Token ownership history

A complete, tamper-proof record of current and historical ownership, enabling transparent transfers and secondary market activity. - Retirement events

The system records on-chain when a carbon credit retires, preventing double counting and enabling real-time auditability. - Immutable references to certificate and registry identifiers

Cryptographic links (hashes or IDs) pointing to the original registry-issued carbon credit, ensuring traceability without duplicating registry data. - Asset images and metadata pointers

Visual representations and metadata references that improve usability, discovery, and marketplace clarity (often stored via IPFS or similar systems, with hashes anchored on-chain).

What Stays Off-Chain

Off-chain systems handle data and processes that require privacy, jurisdictional control, or large storage capacity:

- Jurisdictional compliance and onboarding (KYC/KYB)

We handle identity verification, sanctions screening, and regulatory checks off-chain to meet legal and privacy requirements. - Large documents and verification reports

Project design documents, MRV reports, and audit files remain off-chain, with only immutable references stored on-chain to preserve integrity and reduce costs.

This hybrid architecture ensures carbon tokenization platforms remain compliance-first, cost-efficient, and enterprise-ready, while still delivering the transparency and trust benefits that blockchain infrastructure enables.

The 5-Step Tokenization Process for Web2 Projects

Transitioning existing carbon credits to the blockchain doesn’t mean starting from scratch. Here’s a tried-and-true framework to guide you:

- Credit Verification & Sourcing

Team up with reputable registries like Verra or Gold Standard for verified offsets. Key aspects to consider include: – Vintage (aim for 2020 or newer) – Project type (nature-based versus tech) – Certifications for co-benefits (like SDG alignment) – Contributions to buffer pools - Smart Contract Minting

We Create ERC-3643 tokens tokens linked to each credit’s serial number. This standard allows for both fungible trading. It retains unique metadata too. This metadata tracks project-specific details. These include location, methodology, and co-benefits. - Oracle Integration

Link up with Chainlink oracles to get real-time carbon pricing feeds. Advanced platforms pull in data from various sources. These include traditional OTC prices. They also cover futures markets. Plus fundamental indicators like weather patterns impact nature-based projects. - DEX Deployment & Liquidity

Launch on Uniswap V4 or set up custom AMM pools with liquidity incentives. Successful platforms usually kick off with: 50% from the project itself. 30% from liquidity mining rewards. 20% allocated to strategic partners. - Registry Bridge Implementation

Connect with bridging protocols like Toucan or C3 to ensure cross-standard interoperability. This process generates a “retirement receipt” on the original registry.The system burns tokens during this step. It helps maintain environmental integrity across different systems.

Carbon Tokenization Compliance 2026

Understanding the regulatory landscape is essential for the success of any platform:

- Under the European Union (MiCA): tokenized carbon is categorized as “utility tokens.” This allows easier reporting. Environmental claims must be substantiated. Full compliance is anticipated by the third quarter of 2026.

- United States: SEC has issued no-action letters for carbon tokens that meet certain criteria: they must be backed 1:1 with verified credits, there should be no expectation of profit from the platform’s activities, and there must be clear mechanisms for retiring the tokens.

- Singapore (MAS): has broadened its Digital Payment Token framework to include carbon derivatives, and a sandbox environment is available for testing innovative structures through 2026.

- UAE (VARA): the Virtual Assets Regulatory Authority (VARA) is providing full-stack licensing for platforms operating in regional carbon hubs. To get started, you’ll need a capital reserve of $500K and to establish a local entity.

Future of Carbon Tokenization

The next step in evolution goes beyond just tokenization and dives into programmable carbon assets:

- Automated Carbon Neutrality: Imagine smart contracts that can automatically buy and retire tokens based on real-time emissions data collected from IoT sensors.

- Dynamic Pricing Oracles: Think of AI-driven pricing models that take into account forward curves, policy shifts, and the value of natural resources.

- Cross-Chain Carbon Bridges: This means creating seamless connections between all major registries and blockchain ecosystems, paving the way for a unified global carbon market.

- Regenerative Finance (ReFi) Integration: Here, carbon tokens can serve as collateral for green loans, act as governance tokens in DAO-led conservation initiatives, and even function as yield-generating assets in sustainability-focused DeFi protocols.

The Future with Blocsys: Programmable Carbon Economy

We’re pioneering the next evolution of environmental markets:

- Blocsys Carbon Oracle Network: a decentralized verification system that blends satellite imagery, IoT sensors, and ground truth data to provide real-time credit validation and dynamic pricing.

- Cross-Chain Carbon Hub: an interoperability layer that links all major blockchain ecosystems with traditional registries, paving the way for unified liquidity and verification standards.

- ReFi Integration Framework: offers a smooth connection between tokenized carbon and the latest regenerative finance applications, including green bonds, conservation DAOs, and impact investment vehicles.

- Corporate Carbon Management Suite: End-to-end solutions for enterprise climate programs including automated offsetting, supply chain integration, and sustainability reporting automation.

Why Choose Blocsys Technologies?

Blocsys Technologies – Leading carbon tokenization platform developers delivering production-ready RWA solutions in 6 weeks. Specializing in ERC-3643 smart contracts, Verra/Gold Standard registry integration, DEX deployment, and full-stack compliance for Web2 carbon projects transitioning to Web3.

- Proven Expertise: With over 5 years of dedicated experience in carbon tokenization, we’ve successfully implemented more than 25+ projects across all over the world.

- Security-First Approach: We prioritize security by ensuring that all our smart contracts are audited twice by top security firms. Plus, we offer insurance-backed custody solutions for added peace of mind.

- Regulatory Leadership: We’re actively involved in shaping policy, engaging directly with initiatives like EU MiCA, US climate policy, and international standards for the carbon market.

- Full-Service Model: From initial consultation through ongoing optimization, we provide end-to-end support with dedicated account management.

- Technology Agnostic: We recommend and implement the optimal blockchain solution based on your specific needs, market focus, and regulatory considerations.

Conclusion: Building the Bridge Between Worlds

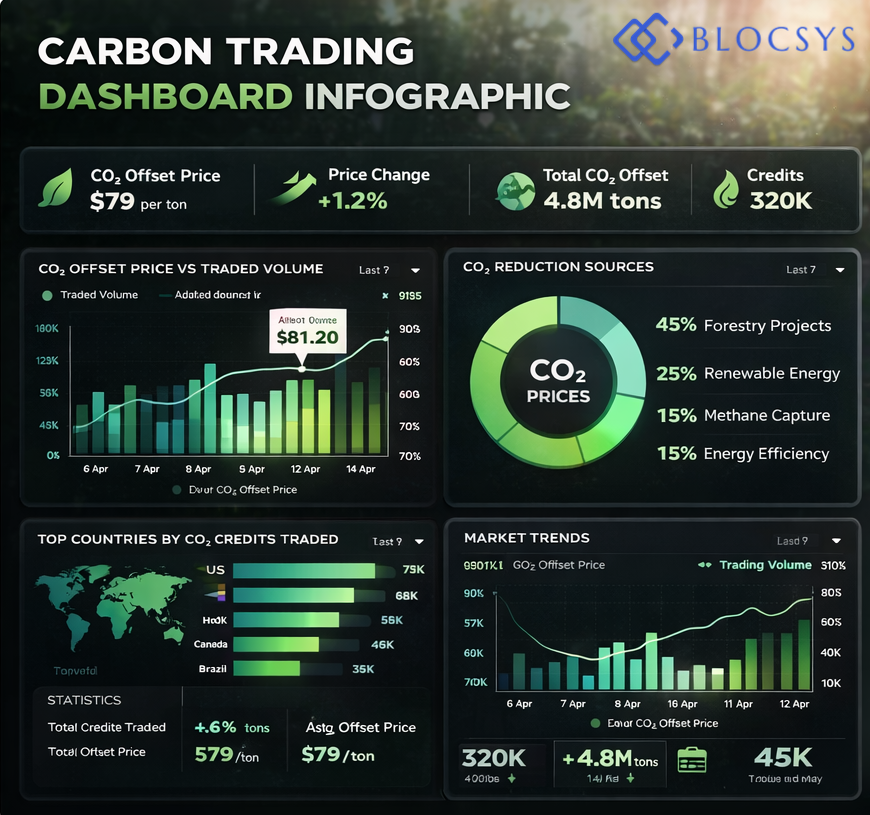

The shift from Web2 to Web3 in carbon markets marks a groundbreaking upgrade in environmental finance.It’s the biggest change since carbon registries were first established. For carbon projects operating in the Web2 space, tokenization brings benefits. These include improved liquidity. It offers clear provenance. Plus, it provides access to fresh financing options. For those looking to build new platforms, this is a huge opportunity, with estimates suggesting it could be worth over $50 billion by 2030.

To succeed, it’s crucial to find the right balance. This balance sits between technological advancements and environmental integrity. It ensures regulatory compliance while enhancing user experience. It also achieves market efficiency alongside impact verification. The platforms that will thrive in this arena won’t just be the most cutting-edge; they’ll be the ones that effectively cater to both established environmental initiatives and the emerging realm of digital finance.

The necessary tools, frameworks, and market structures are already in place. For Web2 companies, the pressing question is no longer whether to adopt tokenization. It’s now about how swiftly they can roll out strategies. This happens in a fast-changing environment.