A token management system is the core engine that governs the entire lifecycle of a digital asset on a blockchain. It’s not just a tool; it’s the central operating system for your tokens, handling everything from their creation and distribution to their final retirement. This system is the mission control that ensures any tokenisation project succeeds.

This guide is for enterprise leaders, CTOs, and Web3 innovators who need a clear, actionable framework for managing digital assets. By the end, you’ll understand the architecture, lifecycle, and strategic decisions required to implement a system that unlocks new liquidity, automates financial processes, and boosts operational efficiency.

What Does a Token Management System Actually Do?

A token management system is the foundational layer that ensures your digital assets—whether representing real-world assets (RWAs), carbon credits, or commodities—are managed securely, efficiently, and compliantly. Without one, managing digital assets at scale is chaotic and insecure. The system provides the governance, security, and automation needed for transparent and trusted digital ownership.

Its importance is rapidly growing in modern finance. For instance, India’s blockchain market, valued at USD 656.99 million in 2024, is projected to hit USD 61,532 million by 2033, driven by the financial sector’s demand for secure, low-cost transaction solutions. You can review the full report on India’s blockchain market growth to see this trend. This growth fuels the tokenisation of assets, a core focus at Blocsys.

A well-architected token management system transforms an illiquid asset into a dynamic, programmable financial instrument. It’s the bridge between a physical or digital good and its liquid representation on a global, accessible ledger.

At its heart, the system handles critical functions that protect the integrity and value of the asset it represents.

Core Functions of a Token Management System

| Function | Description | Business Impact |

|---|---|---|

| Issuance & Minting | Handles the creation of new tokens according to predefined rules like total supply and ownership. | Enables controlled and predictable asset creation, preventing unauthorised inflation. |

| Lifecycle Governance | Manages every stage, from initial distribution and transfers to eventual burning or redemption. | Ensures the asset follows its intended economic model from start to finish. |

| Security & Custody | Protects tokens from theft or unauthorised access through secure wallet infrastructure and protocols. | Builds trust and protects stakeholder value by safeguarding assets against threats. |

| Compliance & Reporting | Automates regulatory tasks like KYC/AML checks and generates immutable audit trails for reporting. | Reduces regulatory risk, lowers compliance costs, and ensures legal adherence. |

| Interoperability | Allows tokens to move and interact across different blockchain networks (bridging). | Unlocks liquidity and utility by expanding the asset’s reach beyond a single ecosystem. |

These capabilities create a seamless, secure, and compliant environment. Without them, a token is a simple digital entry; with them, it becomes a powerful, trustworthy financial tool.

How Does the Token Lifecycle Work?

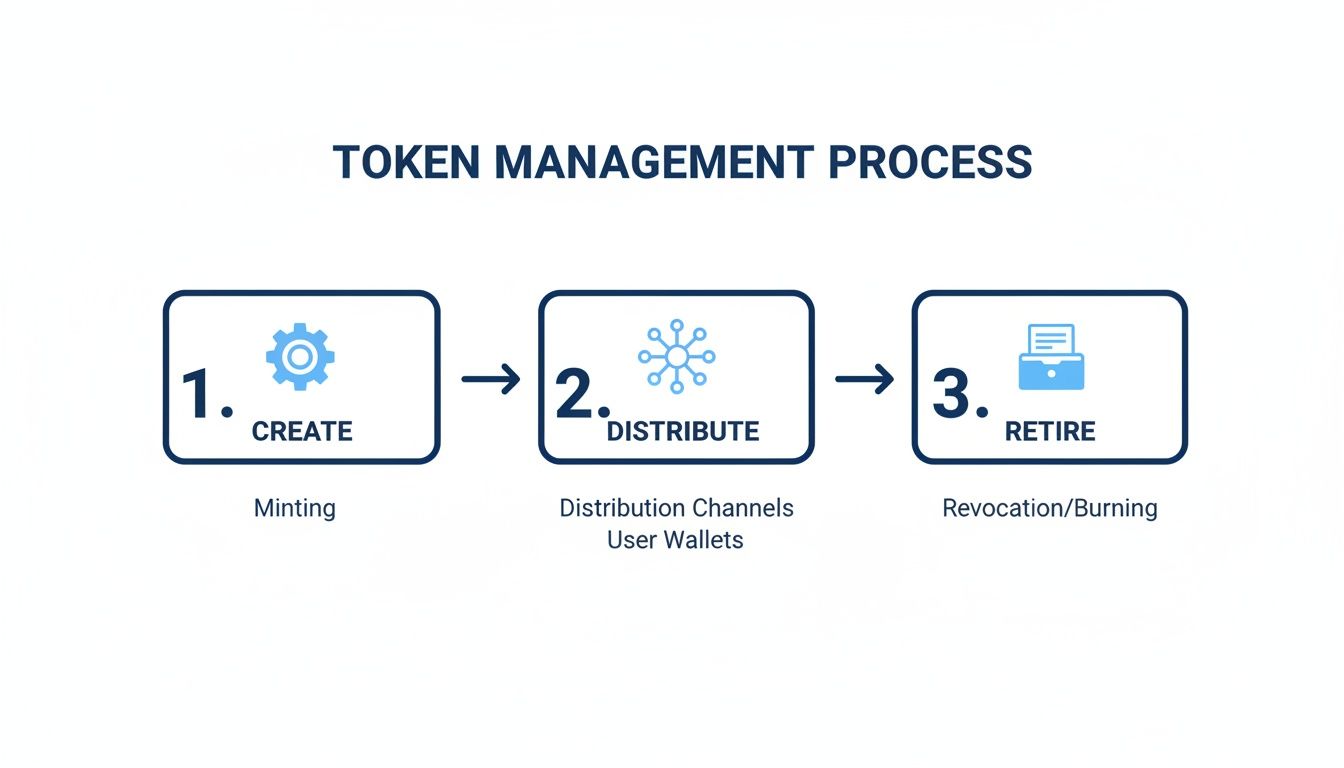

Every digital token has a lifecycle, similar to a physical product’s journey from factory to retirement. A robust token management system oversees this entire path, ensuring each step is secure and compliant. This lifecycle—from creation to removal from circulation—provides a clear framework for planning, execution, and long-term governance.

This diagram outlines the core stages, offering a visual map of the token’s journey from birth to retirement.

A dedicated management system acts as the gatekeeper for each transition, ensuring the asset’s integrity is never compromised.

Stage 1: How Are Digital Assets Created?

The journey begins with issuance, or minting, the moment a digital token is created on the blockchain. This process is governed by a smart contract—a self-executing agreement with predefined rules.

During issuance, critical parameters are permanently coded into the token:

- Total Supply: Defines whether the token’s supply is fixed (like Bitcoin) or inflationary.

- Token Standards: Ensures adherence to standards like ERC-20 (fungible) or ERC-721 (non-fungible), which is vital for ecosystem compatibility.

- Ownership and Permissions: Specifies who has the authority to mint new tokens or manage features.

This initial stage establishes the token’s economic model and functional foundation for its entire existence.

Stage 2: How Are Tokens Distributed?

Once minted, tokens are distributed to their owners. The token management system facilitates various distribution methods, such as initial coin offerings (ICOs), security token offerings (STOs), or airdrops, where tokens are sent directly to user wallets to bootstrap a community. This phase establishes the initial market and user base, and the system ensures distribution occurs accurately and securely, preventing costly errors.

Stage 3: How Are Tokens Used and Traded?

In the active phase, tokens serve their primary purpose—they are used, traded, and integrated into the digital economy. The token management system provides the backbone for these activities, ensuring every interaction is seamless and secure.

Key functions during this stage include:

- Transaction Management: Validating and recording every transfer between wallets on the blockchain.

- Marketplace Integration: Connecting the token to exchanges and DeFi platforms to provide liquidity.

- Utility Enablement: Allowing tokens to be used within applications, for voting in DAOs, or as collateral.

This is the longest part of the lifecycle, where the token’s real-world value is proven. To see how this applies to physical goods, explore our deep dive on real-world asset tokenisation.

Stage 4: How Is a Token’s Lifecycle Concluded?

The final stage involves managing the token’s end-of-life through redemption or retirement. Redemption occurs when a token representing a real-world asset is exchanged back for the underlying asset, removing it from circulation. Alternatively, tokens can be burned (permanently removed from the total supply) to create scarcity or formally close a project.

Governance plays a crucial role here. A token management system can facilitate on-chain voting, allowing token holders to make collective decisions about the asset’s future, such as protocol upgrades or changes to its economic model.

Effective management of this final stage is key to preserving asset value and concluding the process with transparency and trust.

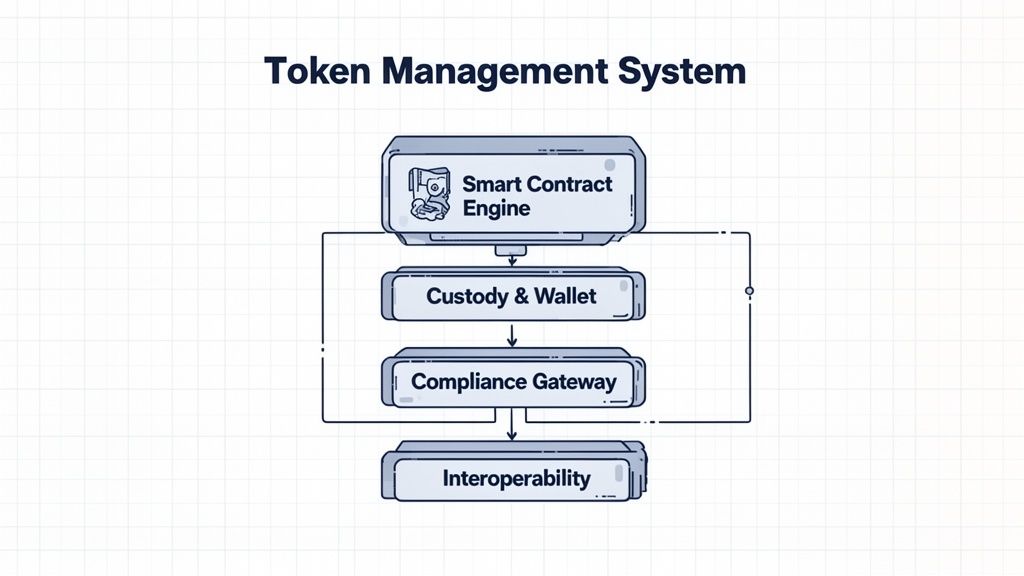

What Are the Key Components of the System Architecture?

Understanding a token management system’s architecture is like viewing the schematic for a high-performance engine. For CTOs and product teams, breaking down its components provides a clear map for building a system that meets specific business goals. Each module has a critical role, and a failure in one can risk the entire system.

Let’s explore the core modules forming the backbone of a modern token management system.

The Smart Contract Engine

At the system’s heart is the Smart Contract Engine, the logic layer where a token’s behaviour is programmed. It encodes the fundamental rules—its “digital physics”—directly onto the blockchain, guaranteeing immutability and self-enforcement.

This engine implements established token standards essential for ecosystem compatibility:

- ERC-20: The universal standard for fungible tokens, where each token is identical and interchangeable.

- ERC-721: The standard for non-fungible tokens (NFTs), where each token is unique and represents specific ownership.

- ERC-1155: A multi-token standard that allows a single contract to manage both fungible and non-fungible tokens, enhancing efficiency.

Custody and Wallet Infrastructure

The Custody and Wallet Infrastructure is the secure vault safeguarding digital assets and the private keys that control them. The system’s security depends on this solution, making it a primary focus for enterprise-grade applications.

Custody approaches include:

- Hot Wallets: Connected to the internet for convenient, frequent transactions but carry higher security risks.

- Cold Storage: Keeps private keys completely offline, offering maximum security against online attacks but slower transactions.

- Multi-Party Computation (MPC): An advanced cryptographic method that splits a private key among multiple parties, eliminating any single point of failure.

Learn how different blockchain models impact security in our guide on hybrid blockchain architectures for enterprises.

The Governance Module

A Governance Module provides a structured framework for decision-making, allowing token holders to propose, debate, and vote on protocol changes. Governance can be on-chain (votes recorded on the blockchain) or off-chain (discussions on platforms before a final on-chain vote). This module ensures the system can adapt while remaining decentralised.

Compliance and Interoperability Layers

The Compliance Gateway automates regulatory checks like Know Your Customer (KYC) and Anti-Money Laundering (AML), integrating with identity verification services. This is non-negotiable for regulated assets. For example, India’s National Blockchain Framework initiatives demonstrate government-level support for compliant tokenisation, enhancing trust in capital markets.

The Interoperability Layer, or bridge, allows tokens to move securely between different blockchain networks. This is crucial for unlocking liquidity and expanding a token’s utility beyond its native ecosystem.

How Do You Choose the Right System Architecture?

Selecting the right architecture—on-chain, off-chain, or hybrid—is a critical strategic decision. There is no one-size-fits-all solution; the optimal model depends on your specific use case and the trade-offs between decentralisation, performance, and cost. This choice will define how your system operates, scales, and integrates with the broader blockchain ecosystem.

What Is the Fully On-Chain Model?

A fully on-chain architecture represents pure decentralisation. Every transaction and state change is recorded directly on a public blockchain, offering unparalleled transparency and immutability. This model is ideal for projects where trust and audibility are paramount, such as digital voting systems or high-value asset provenance tracking. However, this transparency comes with higher costs and slower transaction speeds.

What Is the Off-Chain Model?

An off-chain architecture prioritises speed and cost-efficiency. It operates like a traditional centralised system, using a private database to manage most transactions instantly and at a low cost. The system periodically bundles and “settles” these transactions on the blockchain. This approach is suited for high-frequency environments like crypto exchanges or gaming platforms, but it sacrifices real-time on-chain transparency.

What Is the Hybrid Model?

The hybrid model offers a pragmatic middle ground, combining the best of both worlds. It keeps critical functions like asset issuance and final settlement on-chain for security while moving high-volume operations off-chain for speed and cost savings. This balanced approach is popular among enterprises. For example, a real-world asset tokenisation platform might keep property ownership records on-chain while processing frequent rental payments off-chain.

The decision between on-chain, off-chain, or hybrid is not just technical—it’s strategic. It defines the user experience, operational cost, and security profile of your entire token ecosystem.

Comparing On-Chain vs. Off-Chain vs. Hybrid Architectures

This table compares the three architectural models across key criteria to help you identify the best fit for your project.

| Attribute | On-Chain Model | Off-Chain Model | Hybrid Model |

|---|---|---|---|

| Security | Highest level, inherited directly from the public blockchain’s consensus mechanism. | Relies on the security of a centralised server, creating a single point of failure. | High security for on-chain components, with off-chain elements requiring separate security measures. |

| Scalability | Limited by the blockchain’s throughput (transactions per second). | Highly scalable, capable of handling a very large volume of transactions quickly. | Balanced scalability, leveraging off-chain processing for performance while keeping key assets secure on-chain. |

| Cost | High, as every transaction incurs a network fee (“gas fee”). | Very low, as most operations do not interact directly with the blockchain. | Moderate, with costs optimised by performing only critical transactions on-chain. |

| Complexity | Relatively straightforward in concept but can be complex to optimise for cost and speed. | Simpler to develop and manage, using familiar database technologies. | The most complex to design and implement, requiring careful integration between on-chain and off-chain systems. |

| Transparency | Fully transparent, with all transactions publicly auditable on the blockchain. | Opaque, as internal transactions are not visible on a public ledger. | Partial transparency, with key events visible on-chain while other activities remain private. |

Ultimately, a decentralised autonomous organisation (DAO) will likely favour a fully on-chain model for maximum trust, while a fintech app may lean towards a hybrid solution to meet user demands for speed and low fees.

What Are Some Real-World Examples of Token Management?

The true test of a token management system is its performance in live markets, where it can solve persistent industry problems. Real-world applications demonstrate how this technology delivers tangible value through enhanced transparency, liquidity, and operational efficiency, particularly in sectors like sustainable finance and commodities.

Let’s explore two powerful use cases: the carbon credit market and commodity tokenization.

How Does Token Management Revolutionise Carbon Credits?

The voluntary carbon market has long struggled with issues like double-spending and a lack of transparency. A token management system addresses these challenges by creating a single, immutable record for every carbon credit.

From the moment a credit is tokenized, its entire journey is tracked:

- Verifiable Issuance: Each token represents one verified metric tonne of CO2 removed, with its origin data permanently locked.

- Transparent Transfers: Every sale or transfer is logged on the blockchain, creating a clear, auditable chain of ownership.

- Immutable Retirement: When a credit is used for offsetting emissions, its corresponding token is permanently “burned,” making it impossible to reuse or resell.

This process eliminates the risk of the same credit being sold multiple times, injecting much-needed trust and integrity into the market.

By putting carbon credits on a blockchain, a token management system transforms an abstract environmental claim into a transparent, verifiable, and tradable digital asset. This strengthens market credibility and directs capital more effectively toward climate solutions.

How Does Tokenization Unlock Liquidity in Commodities?

Commodities like gold are valuable but have traditionally been illiquid and difficult to divide. Tokenization, powered by a robust management system, breaks down these barriers.

In India, the asset tokenization market is projected to grow from USD 122.4 million in 2025 to USD 222.3 million by 2032, with blockchain platforms commanding a dominant 34.8% share. You can explore more about India’s asset tokenization market trends on coherentmarketinsights.com.

For an asset like gold, tokenization offers several advantages:

- Fractional Ownership: Investors can buy a small fraction of a physical gold bar, lowering the barrier to entry.

- Enhanced Liquidity: Tokenized gold can be traded 24/7 on global digital asset exchanges, creating a more fluid market.

- Automated Compliance: Regulatory rules can be embedded into the token’s smart contract, automating compliance for every transaction.

These examples show that a token management system is a strategic tool that solves real-world problems and unlocks new economic models.

Your Strategic Implementation Roadmap

A strategic implementation roadmap is the blueprint that turns your token management concept into a secure, compliant, and operational platform. It breaks the process into logical phases, guiding you from high-level vision to a successful launch.

Phase 1: Strategy and Discovery

This foundational phase is about defining the why and the what before writing any code.

- Define Business Goals: Clarify what you want to achieve—unlocking liquidity, creating a transparent supply chain, or launching a new digital marketplace.

- Establish a Legal Framework: Consult legal experts to navigate regulations, determine if your token is a security, and map out KYC/AML requirements.

- Analyse Technical Requirements: Outline core functionality, including token standards (ERC-20, ERC-721), governance models, and essential security protocols.

Phase 2: Technology Selection and Design

With a clear strategy, it’s time to choose your tools and make key architectural decisions.

- Blockchain Choice: Evaluate platforms like Ethereum, Polygon, or Solana based on security, cost, scalability, and ecosystem maturity.

- Architecture Model: Decide whether a fully on-chain, off-chain, or hybrid model best fits your performance and decentralisation needs.

- Vendor and Partner Selection: Identify trusted partners for specialised components like institutional-grade custody or automated compliance.

Phase 3: Development and Security

This is the build phase, with a relentless focus on secure code and integrated security measures.

A critical mistake is treating security as an afterthought. It must be embedded into the development lifecycle from day one, not bolted on at the end. This includes everything from smart contract logic to key management protocols.

- Smart Contract Development: Write and rigorously test the smart contracts that define your token’s rules.

- Security Audits: Engage third-party auditors for exhaustive code reviews and penetration testing to find vulnerabilities before launch.

- Key Management Implementation: Establish robust protocols for managing private keys, using solutions like Multi-Party Computation (MPC) for enterprise-grade protection.

Phase 4: Launch and Ongoing Governance

This final phase involves a smooth deployment, user onboarding, and activating long-term governance.

- Phased Rollout: Consider a soft launch or beta program with a limited audience to fix any last-minute bugs.

- User Onboarding: Provide clear documentation and support channels to help users adopt the system.

- Governance Framework: Activate your governance module to empower token holders to participate in decision-making and guide the project’s future.

Frequently Asked Questions

What Is the Main Purpose of a Token Management System?

A token management system acts as the complete command centre for a digital asset. Its primary purpose is to provide the secure, automated framework needed to manage a token’s entire lifecycle on the blockchain—from creation (minting) and distribution to governance, compliance, and final retirement (burning).

How Does a Token Management System Ensure Security?

Security is achieved through a multi-layered approach. It begins with meticulously audited smart contracts to prevent exploits. This is followed by robust custody solutions for private keys, such as cold storage or Multi-Party Computation (MPC), which eliminate single points of failure. The system also integrates strict access controls and compliance gateways to block unauthorised activities.

Can a Token Management System Work Across Different Blockchains?

Yes, modern systems are designed for interoperability. They use technologies like bridges or cross-chain protocols that allow tokens to move securely between different blockchain networks. This prevents assets from being siloed in one ecosystem, unlocking greater liquidity and utility across the entire digital asset market.

A key function of a modern token management system is to act as a universal translator for digital assets. It ensures that a token’s value and identity remain consistent, whether it’s operating on Ethereum, Polygon, or another network, thereby unlocking its full market potential.

What Is the Difference Between Token Issuance and Distribution?

Issuance (or minting) is the technical process of creating the token on the blockchain, where its fundamental properties like total supply are permanently defined. Distribution is the subsequent process of delivering those newly created tokens to their rightful owners through methods like a public sale, an airdrop, or private placement.

How Do You Choose Between On-Chain and Hybrid Architectures?

The choice depends on your project’s goals. A fully on-chain architecture offers maximum transparency and decentralisation, making it ideal for governance systems where trust is paramount. A hybrid architecture balances security and performance by keeping critical records on-chain while handling high-frequency transactions off-chain, a common choice for enterprise platforms like RWA tokenization.

Ready to build a secure, scalable, and compliant tokenisation platform? Blocsys Technologies PVT LTD offers end-to-end development for real-world assets, carbon credits, and commodities. Explore our solutions at https://blocsys.com.