So, what is a carbon credit? In simple terms, it's a tradable permit representing the right to emit one tonne of carbon dioxide equivalent (tCO2e). It functions as a financial instrument allowing a company to compensate for its own emissions by funding a project that reduces, avoids, or removes an equivalent amount of greenhouse gases from the atmosphere.

This guide is for leaders and innovators in the Web3, blockchain, and AI sectors who are evaluating the carbon market. By the end, you'll understand how carbon credits work, the critical risks involved, and how technology is creating a more transparent and liquid market—enabling you to make informed strategic decisions.

Before we dive deeper, let's break down the core components of a carbon credit.

What are the Core Components of a Carbon Credit?

A carbon credit is defined by four key attributes that enable it to function as a market-based tool for climate action. For decision-makers in technology and finance, understanding these components is crucial for evaluating their quality and investment potential.

| Attribute | Description for Decision-Makers |

|---|---|

| Unit of Measurement | Each credit represents a standardised unit: one tonne of CO2 equivalent (tCO2e) reduced or removed. This standardisation is what makes them comparable and tradable. |

| Tradable Instrument | It can be bought and sold on a marketplace, giving it a financial value. This transforms an environmental benefit into a liquid asset, enabling capital flow to climate projects. |

| Offsetting Mechanism | Allows an entity to compensate for its emissions by supporting external climate projects. This is a primary mechanism for companies to meet ESG and Net Zero targets. |

| Verification | Must be verified by an independent third-party standard (like Verra or Gold Standard) to ensure the emission reduction is real, measurable, and permanent. This is the foundation of a credit's quality and credibility. |

These attributes come together to create a market-based tool for climate action.

How Do Carbon Credits Drive Climate Action?

At its core, a carbon credit is a financial instrument designed to make greenhouse gas reduction an economically attractive proposition. By creating a measurable and tradable unit for carbon, it effectively turns emission reduction into an asset. This mechanism is now fundamental for companies serious about their Environmental, Social, and Governance (ESG) targets and Net Zero goals.

The concept empowers organisations to take direct responsibility for their carbon footprint. When a company cannot completely eliminate emissions from its own operations—a common challenge for both enterprises and startups—it can buy carbon credits. These credits are generated by projects that can cut emissions, creating a powerful flow of capital into green initiatives worldwide.

The Financial Incentive for Decarbonization

The system works by putting a price on carbon pollution. This encourages businesses to invest in cleaner technologies and more efficient processes to avoid paying that price. The financial benefits then flow directly to projects actively fighting climate change, such as:

- Reforestation and Afforestation: Planting new trees that pull CO2 out of the atmosphere.

- Renewable Energy: Building wind, solar, or hydro projects that replace fossil fuel energy.

- Methane Capture: Using technology on farms or at landfills to capture and destroy potent greenhouse gases.

This market-based approach is gaining significant traction. In India's fast-growing carbon market, valued at over USD 33 billion, voluntary credits accounted for 58.04% of revenue in 2023. This explosive growth is fuelled by corporate Net Zero pledges and a surge in investment for nature-based solutions. You can find more data on the Indian carbon market on the IMARC Group's website.

Ultimately, a carbon credit is far more than a certificate. It’s a vital tool for channelling capital toward a sustainable, low-carbon future. For any forward-thinking organisation looking to navigate the new climate economy, understanding how these credits work is the essential first step.

What is the Difference Between Voluntary and Compliance Carbon Markets?

To fully grasp what a carbon credit is, you must understand the two distinct markets where they are traded: the compliance market and the voluntary market. Each operates under a different set of rules, driven by different motivations, and presents unique opportunities and risks for participants.

The compliance carbon market is driven by regulation. Governments or international bodies set a mandatory limit, or ‘cap’, on the total greenhouse gas emissions allowed for specific industries (e.g., power generation, heavy manufacturing). For these companies, participation is not a choice—it’s the law.

Think of it as a strictly enforced rulebook. Businesses that reduce emissions below their allowance can sell their surplus permits as carbon credits. Conversely, firms that exceed their limit must buy credits to comply. This “cap-and-trade” system creates a direct financial penalty for excessive pollution and a clear reward for efficiency.

Why is the Voluntary Carbon Market Growing?

On the flip side, the voluntary carbon market (VCM) operates on choice. Here, companies, non-profits, and even individuals purchase carbon credits to meet their own climate goals. This market is fuelled by corporate social responsibility, ESG (Environmental, Social, and Governance) targets, and increasing pressure from consumers and investors for businesses to lead on climate action.

The voluntary market is where organisations can go beyond regulatory compliance. It channels funding into a diverse range of global climate projects—from reforesting the Amazon to deploying clean cookstoves in rural communities. It’s a powerful mechanism for demonstrating a genuine commitment to sustainability and is a primary focus for Web3 and AI innovation.

While both markets aim to cut emissions, their mechanics differ significantly.

- Drivers: Compliance markets are created by national or regional laws (e.g., EU ETS). Voluntary markets are shaped by corporate net-zero pledges, brand reputation, and stakeholder demands.

- Pricing: In compliance markets, prices are tied to the stringency of government caps and penalties. In the VCM, prices vary widely based on project type, verification standard (Verra, Gold Standard), co-benefits (like biodiversity), and market demand.

- Participants: Compliance markets are limited to regulated entities. The VCM is open to any organization or individual aiming to offset their carbon footprint.

How are Governments Structuring Compliance Markets?

Globally, compliance markets are constantly evolving to meet more ambitious climate targets. Take India, for example. The new Carbon Credit Trading Scheme (CCTS) is set to redefine its compliance landscape by establishing Carbon Credit Certificates (CCCs) as the official unit. The scheme is establishing a registry and setting emission targets for key sectors like power and steel, with initial trading expected soon. This shift is part of a larger global trend toward more structured, government-led carbon pricing. You can find more details about India's CCTS on Carbon Pulse.

In summary, the compliance market is for managing regulatory risk, while the voluntary market is for demonstrating proactive environmental leadership. Both are essential for funding climate solutions and building a sustainable global economy.

What is the Lifecycle of a Carbon Credit?

A carbon credit doesn't just appear out of thin air. It follows a rigorous, multi-step journey designed to ensure every single credit represents a real, verified tonne of CO2 reduction. For investors and innovators, understanding this lifecycle is key to assessing a credit's quality and mitigating reputational risk. The entire process is built on transparency and accountability.

The journey starts with a carbon project. This could be a large-scale reforestation initiative, a project capturing methane from a landfill, or an innovative direct air capture facility. Project developers must first prove their activity genuinely reduces emissions compared to a "business-as-usual" baseline scenario.

From Project Concept to Verified Credit

Once a project is underway, it enters a strict validation and verification phase overseen by independent bodies to guarantee its integrity and impact.

The process typically unfolds in these stages:

- Methodology Application: The project must follow a scientifically approved methodology, which acts as the rulebook for measuring, monitoring, and verifying its emission reductions.

- Third-Party Validation: An independent, accredited auditor reviews the project's design to confirm it meets the standard’s requirements for critical principles like additionality and permanence.

- Ongoing Monitoring: Project developers must continuously track and report on their progress, collecting data to prove the claimed emission reductions are actually occurring.

- Verification and Issuance: The same (or another) third-party auditor periodically verifies the monitored results. If the data is sound, they submit a verification report to a carbon registry.

Only after this exhaustive process does a registry like Verra officially issue the carbon credits. Each credit receives a unique serial number to prevent it from being sold twice.

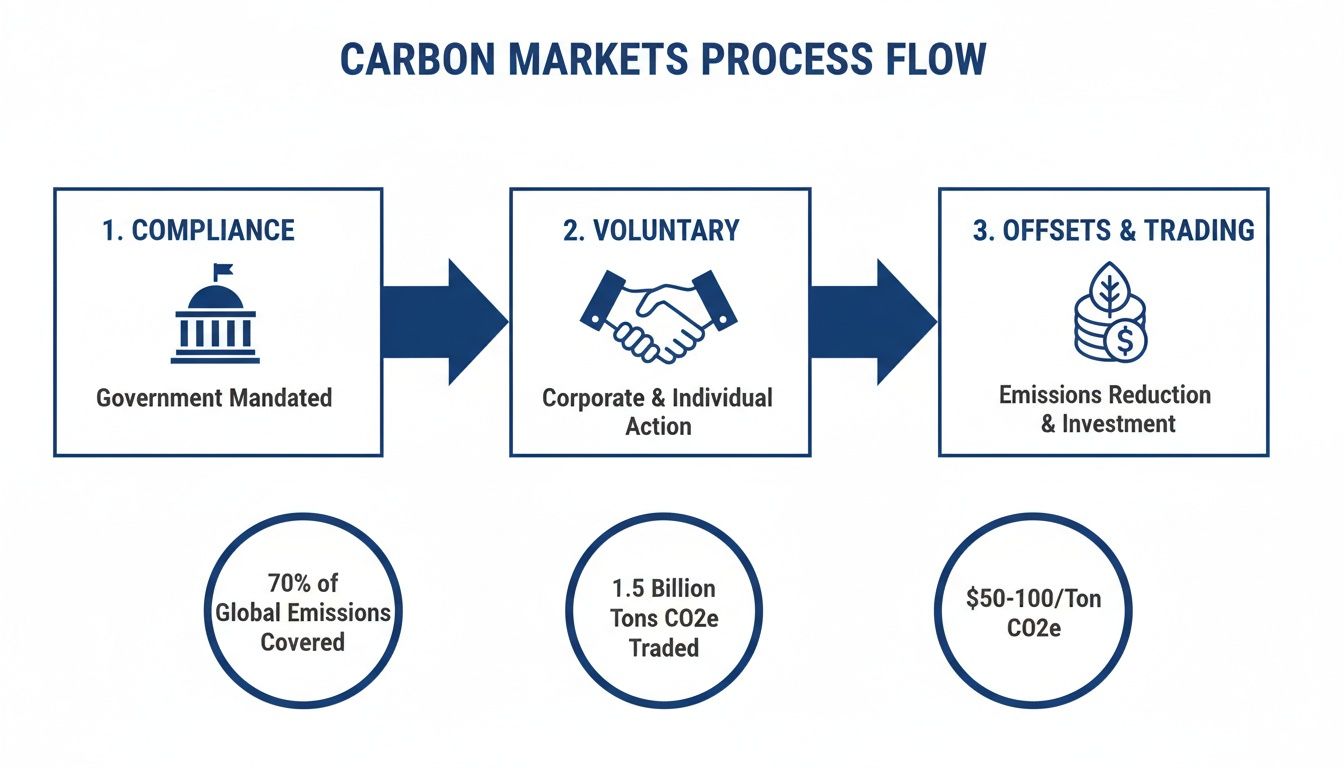

The chart below illustrates the distinct pathways within the carbon markets, highlighting the difference between government-mandated compliance schemes and corporate-led voluntary actions.

This visual shows that while motivations differ, both markets aim to place a real value on carbon reductions and drive climate action.

What is Carbon Credit Retirement?

The lifecycle of a carbon credit ends with retirement.

When a company buys a credit to offset its emissions, it must "retire" it on the public registry. This action permanently removes the credit from circulation, ensuring it cannot be traded, sold, or used again. This final step is crucial for making a credible environmental claim.

A carbon credit's retirement is its ultimate purpose. It signifies that the environmental benefit has been claimed, turning a tradable asset into a permanent, accounted-for emission reduction.

Leading registries provide a public database where anyone can track a credit from issuance to retirement. This transparent ledger is the market's primary defense against issues like double counting. Every step in this lifecycle is designed to build trust and ensure that an investment in a carbon credit funds a legitimate, verified climate solution.

What are the Key Risks in Carbon Markets?

To fully trust what a carbon credit represents, it is critical to address the market's biggest challenges. For any organization evaluating climate investments, understanding these risks is the first step toward making credible and impactful decisions. These are not just academic debates; they are real threats to a project's environmental integrity and your organization's reputation.

Confronting these issues head-on also frames the conversation around why technologies like blockchain and AI are becoming necessary to build a transparent and accountable market for the future.

The Challenge of Additionality

The most fundamental criticism revolves around one concept: additionality. It asks a simple but crucial question: would these emission reductions have happened anyway, even without the revenue from selling carbon credits? If the answer is yes, the project isn't truly "additional," and the credits it generates offer no real climate benefit.

For example, a renewable energy project that is already profitable from selling electricity to the grid would likely fail the additionality test. Buying credits from such a project may not create new climate action, potentially exposing the buyer to accusations of greenwashing.

Permanence and Leakage Risks

Beyond additionality, two other major risks are frequently debated, especially for nature-based solutions like forestry projects.

- Permanence: This risk addresses how long the captured carbon will remain stored. A forest planted for a carbon project could be destroyed by a wildfire or illegal logging in 50 years, releasing all that stored carbon back into the atmosphere. True climate impact requires long-duration storage.

- Leakage: This occurs when a project inadvertently shifts the emissions-causing activity elsewhere. For example, protecting one area of forest might cause loggers to move to a neighboring, unprotected area. If this "leakage" isn't properly accounted for, the net climate benefit could be zero or even negative.

Understanding these risks is essential for navigating the market effectively. A failure to perform due diligence can lead to wasted expenditure on low-quality credits and expose an organisation to accusations of greenwashing.

This is precisely where technology offers a path forward. Tracking these complex variables is a massive data and accounting challenge. As we cover in our guide to carbon accounting tools, traditional methods often fall short. This gap creates a clear need for more robust, transparent, and verifiable systems to ensure every carbon credit represents a real and lasting impact on the climate.

How Can Blockchain and AI Improve Carbon Markets?

The persistent challenges of the carbon market—additionality, permanence, and leakage—all stem from a core problem: a lack of trust and transparency. This is precisely where Web3 technologies are making a significant impact, transforming the carbon credit from an opaque certificate into a fully traceable digital asset.

When you tokenise a carbon credit as a Real-World Asset (RWA) on a blockchain, its entire history becomes transparent and immutable. From project verification to final sale and retirement, every transaction is recorded on a public ledger. This creates an auditable "golden record," virtually eliminating the risks of double-counting and fraud.

This shift does more than just improve accounting; it injects new levels of integrity and liquidity into the market. Tokenised credits can be traded instantly on global digital marketplaces, giving high-impact climate projects access to a much wider pool of capital.

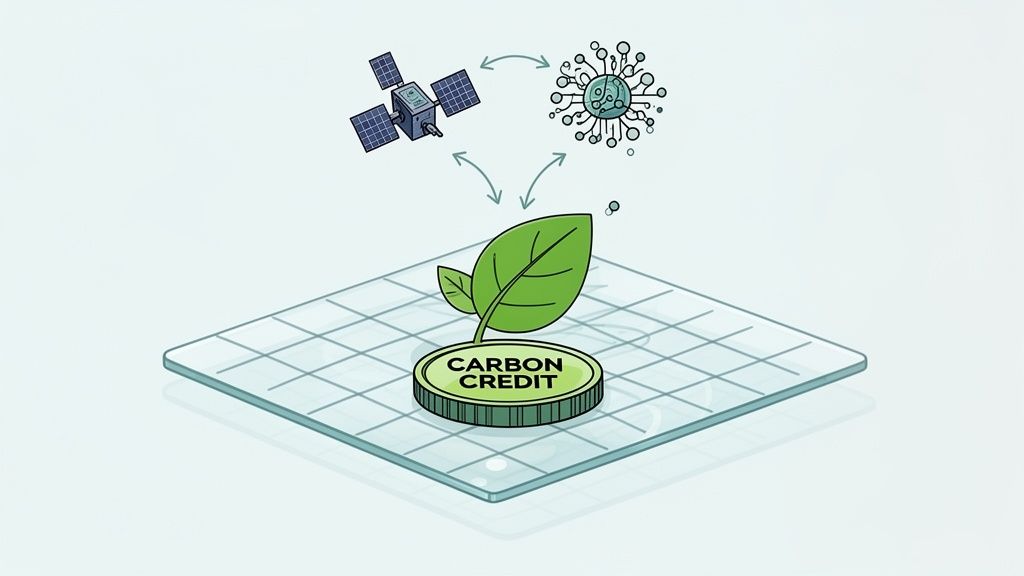

How Does AI Enhance Verification?

While blockchain provides the transparent ledger, Artificial Intelligence (AI) is the engine that supercharges the data recorded on it. AI agents can analyze vast amounts of data from satellites, drones, and IoT sensors to monitor projects in near real-time. The implications are transformative.

- Real-Time Monitoring: Instead of relying on periodic reports, AI can analyze satellite imagery to confirm a forest's health or detect signs of illegal logging, directly addressing the permanence problem.

- Predictive Analytics: Machine learning models can analyze market trends to forecast carbon credit prices, helping project developers and buyers make smarter financial decisions.

- Automated Verification: AI can automate parts of the Measurement, Reporting, and Verification (MRV) process—a notoriously complex and expensive part of the system—reducing costs and human error.

By combining a tamper-proof ledger with intelligent data analysis, blockchain and AI are transforming a slow, manual verification process into a dynamic, data-driven system. This is the bedrock for building a carbon market that is trustworthy, global, and scalable.

This technological evolution is gaining significant government backing. India's government, for example, is investing Rs 20,000 crore ($2.4 billion) into carbon capture technologies that will integrate with its national trading scheme, signaling a clear move toward a tech-enabled future for carbon markets.

Building Secure and Compliant Digital Markets

As carbon credits become digital assets, security and compliance are paramount. The integrity of these new markets depends on robust protocols that prevent illicit activity. Integrating tools for on-demand KYT compliance is key to enhancing transparency and mitigating fraud.

Tokenising carbon credits as RWAs requires a standardised playbook to ensure interoperability across platforms. This is where new token standards are critical. Our guide on the ERC-7943 universal RWA standard breaks down the framework designed to achieve just that.

To see the difference this technology makes, let’s compare the traditional and blockchain-based approaches.

Traditional vs. Blockchain-Based Carbon Markets

| Challenge | Traditional Market Approach | Blockchain and AI Solution |

|---|---|---|

| Double-Counting | Relies on manual checks and siloed, private registries, creating opportunities for the same credit to be sold twice. | Each credit is a unique token on an immutable public ledger, making double-spending impossible. |

| Lack of Transparency | Opaque lifecycle data makes it difficult for buyers to verify a credit's origin, quality, and impact. | The entire history of a credit—from issuance to retirement—is publicly auditable on the blockchain. |

| Inefficient Verification | The MRV process is slow, expensive, and prone to human error, creating long delays for project developers. | AI automates data collection and analysis from sensors and satellites, providing real-time, objective verification. |

| Limited Liquidity | Markets are fragmented, with high transaction costs and limited access for smaller buyers and sellers. | Tokenised credits can be traded instantly on global 24/7 markets, increasing liquidity and price discovery. |

| Fraud & Greenwashing | It’s hard to prove claims of "additionality" or "permanence," leaving the door open for low-quality projects. | AI-powered monitoring provides continuous, verifiable data, ensuring credits represent real, lasting climate action. |

By combining technological innovation with smart regulation, we can build a carbon market that is finally fit for the future.

How Can Organizations Build Scalable Carbon Tokenization Platforms?

Transitioning from concept to a market-ready product is the most critical challenge in connecting climate finance with Web3 infrastructure. Building a platform that effectively tokenises carbon credits as Real-World Assets (RWAs) requires deep engineering expertise. This is where a partner like Blocsys provides end-to-end capabilities to create powerful, white-label tokenisation platforms.

To build these platforms effectively, a solid grasp of what crypto tokens are is essential. As foundational building blocks, they enable the creation of a transparent and liquid market for carbon credits, as explained in guides like Domino's "What Are Crypto Tokens?". This process is not just about minting a token; it's about engineering a secure, scalable, and compliant ecosystem from the ground up.

What is the Core Engineering for Carbon Infrastructure?

A market-ready platform is built on key technical pillars that solve the core problems enterprises and Web3 innovators face. Our approach focuses on mastering this foundational engineering:

- Secure Smart Contract Development: We design, build, and audit the smart contracts governing the entire lifecycle of a tokenised carbon credit—from issuance and transfer to fractionalisation and retirement—ensuring every action is transparent and tamper-proof.

- Custom dApp and Platform Design: User adoption is critical. We build intuitive decentralised applications (dApps) and interfaces that simplify the process of buying, selling, and managing tokenised credits for all market participants.

- AI-Powered Verification and Analytics: We integrate AI agents to automate data analysis for project verification and provide predictive insights into market trends, adding a crucial layer of intelligence to the platform.

By focusing on these core elements, we provide the foundational technology needed to launch next-generation carbon infrastructure. The goal is to create a secure, scalable, and fully auditable system that builds trust and unlocks global liquidity.

For organisations ready to lead in this space, understanding the development roadmap is the first step. Our detailed guide explains it all; learn more about building a future-proof system in our carbon tokenisation platform development guide. At Blocsys, we translate complex Web3 concepts into market-ready solutions that deliver real results.

Answering Your Key Questions About Carbon Credits

As decision-makers explore the carbon markets, several key questions consistently arise. Here are the clear, concise answers you need to know.

How Is the Price of a Carbon Credit Determined?

The price of a carbon credit is determined by supply and demand, but the drivers differ between markets. In compliance markets, prices are driven by government-set emissions caps and the financial penalties for non-compliance. In the voluntary market, pricing is more complex, influenced by project quality, type (e.g., nature-based vs. technology), co-benefits like biodiversity protection, and the verification standard used.

What Is the Difference Between a Carbon Credit and a Carbon Offset?

These terms are often used interchangeably, but they represent different concepts. A carbon credit is the tradable financial instrument representing one tonne of CO2 reduction or removal. A carbon offset is the action of using that credit to compensate for one's own emissions. In short, you buy a carbon credit to create a carbon offset.

Can Individuals Buy Carbon Credits?

Yes, individuals can buy carbon credits, typically through specialised retail platforms or brokers that aggregate credits from various projects. This allows people to voluntarily offset their personal carbon footprint from activities like air travel or home energy consumption. A growing number of services are making it easier for individuals to support climate projects by purchasing and retiring credits.

What Does It Mean to Retire a Carbon Credit?

Retiring a carbon credit is the final step in its lifecycle. It means permanently removing the credit from circulation so it cannot be sold, traded, or used again. This action is publicly recorded on a registry like Verra or Gold Standard and officially claims the environmental benefit associated with that one-tonne CO2 reduction. Retirement is crucial for preventing double-counting and ensuring the climate impact is real.

Building the next generation of carbon markets requires robust, scalable, and secure technology. Blocsys specialises in developing end-to-end RWA tokenisation platforms and AI-driven verification systems that bring transparency and liquidity to the carbon economy.

Ready to build the future of climate finance? Connect with our experts to explore how our Web3 and AI solutions can help you execute your vision effectively.