Crypto trading bot development is a fusion of software engineering, financial strategy, and data analysis. It involves creating an automated system to execute trades 24/7, reacting to market volatility faster than any human. This guide provides a definitive blueprint for developers, technical leaders, and financial innovators aiming to build secure, scalable, and profitable trading bots.

Whether you’re an enterprise launching a commercial platform or a startup automating proprietary strategies, this article will walk you through the entire development lifecycle. We will cover how to architect a resilient system, implement sophisticated trading logic, embed critical risk management, and deploy your bot for rock-solid reliability, ensuring you can navigate the unique challenges of the crypto markets.

What Is a Crypto Trading Bot?

A crypto trading bot is a software program that automates trading strategies on cryptocurrency exchanges. It uses APIs to connect to exchanges, analyze real-time market data, and execute buy or sell orders based on a predefined set of rules. The primary goal is to remove emotion from trading and execute strategies at a speed and frequency impossible for a human trader.

At its core, crypto trading bot development is a specialized form of algorithmic trading. These bots automate everything from market analysis to trade execution, unlocking strategies that are simply impossible to run manually. By the end of this guide, you’ll have a clear blueprint to design, build, and deploy a robust trading bot tailored to your exact goals.

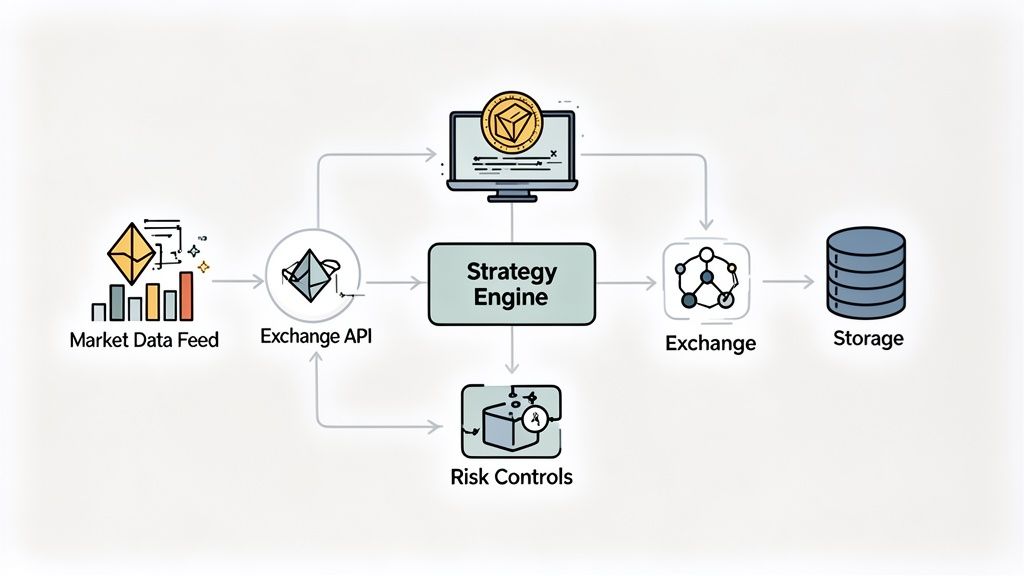

What Are the Core Components of a Trading Bot?

A high-performance crypto trading bot is built on a modular architecture where each component has a specific role. Getting this structure right from the start is crucial for creating a system that is scalable, maintainable, and resilient.

| Component | Primary Function | Key Consideration |

|---|---|---|

| Data Feed Handler | Ingests real-time market data (prices, order books) via APIs or WebSockets. | Latency is critical. Must handle high-volume, high-velocity data without dropping connections. |

| Strategy Engine | Contains the core trading logic and rules that generate buy or sell signals. | Modularity is key. Design it to easily plug in different strategies (e.g., trend-following, arbitrage). |

| Execution Module | Places, manages, and cancels orders on the exchange via its API. | Needs robust error handling for failed orders, API rate limits, and partial fills. |

| Risk Management | Enforces rules like position sizing, stop-loss limits, and portfolio exposure. | This is your safety net. It should be able to override the strategy engine to prevent catastrophic losses. |

| Portfolio Manager | Tracks current positions, calculates P&L, and monitors overall portfolio health. | Must maintain an accurate, real-time state of your assets across exchanges. |

| Data Storage | Logs all trades, market data, and bot activity for analysis and backtesting. | Choose a database that can handle time-series data efficiently for performance analysis. |

These components form the backbone of any serious trading bot. Let’s explore how to assemble them into a cohesive and performant system.

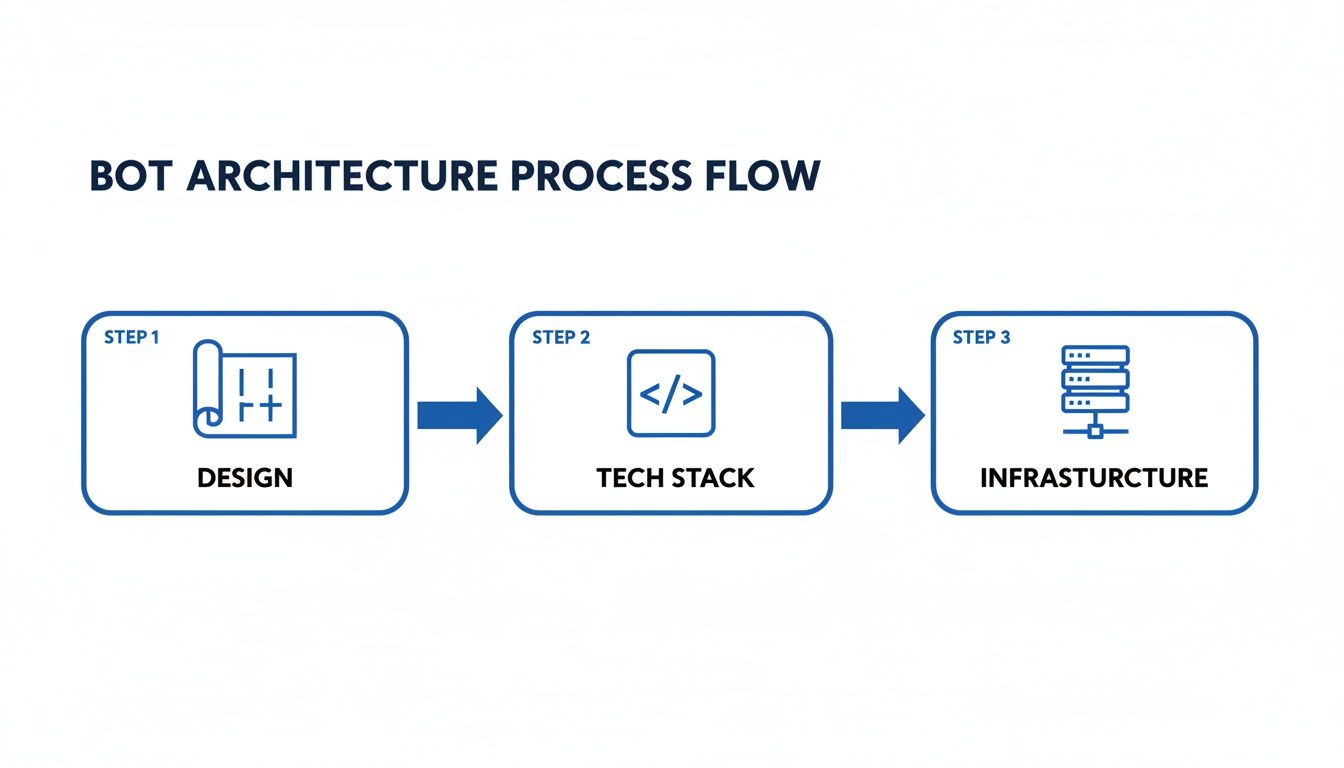

How Do You Architect a Crypto Trading Bot?

The success of your crypto trading bot is decided long before you write the first line of strategy code. It’s forged in its architecture—the foundational structure that dictates speed, reliability, and the ability to grow. Getting this right is non-negotiable for any serious crypto trading bot development project.

Step 1: Choose Your Architectural Model (Monolith vs. Microservices)

The first critical decision you’ll face is choosing between a monolithic or a microservices architecture.

- Monolithic Architecture: Bundles all components into a single application. This approach is simpler and faster for initial development, making it ideal for prototypes or personal single-strategy bots.

- Microservices Architecture: Breaks the bot into smaller, independent services (e.g., data ingestion, strategy execution, portfolio management). This design is far superior for enterprise-grade platforms, as it allows you to update, scale, or fix individual components without bringing the entire system down.

Decision Framework: For startups and prototypes prioritizing speed to market, a monolith is often sufficient. For enterprise systems requiring high availability, scalability, and long-term maintainability, a microservices architecture is the mandatory choice.

Step 2: Select the Right Technology Stack

Your choice of programming language and tools will directly impact your bot’s performance. There’s no single “best” language; the right choice really depends on your priorities—be it development speed, raw performance, or memory safety.

Here’s a breakdown of the most popular choices in professional crypto trading bot development:

- Python: Unbeatable for rapid prototyping, backtesting, and data analysis. Its massive ecosystem of libraries (like Pandas and TA-Lib) makes it incredibly easy to experiment with complex strategies. The catch? Its performance limitations can become a bottleneck for high-frequency trading.

- Go (Golang): A fantastic middle ground. It offers excellent performance and has built-in support for concurrency (goroutines), making it perfect for handling simultaneous data streams and API connections. Its simplicity and fast compilation have made it a favourite for building high-performance, maintainable systems.

- Rust: When absolute performance and safety are paramount, Rust is the top contender. It gives you C++ level speed without the memory-related risks, thanks to its strict compiler. The trade-off is a steeper learning curve, but for high-stakes, low-latency applications, it’s often worth the investment.

Step 3: Design a Robust Infrastructure Core

Beyond the code, the underlying infrastructure determines whether your bot can handle the relentless firehose of market data. Two components are particularly crucial here.

First up is your database. While a standard SQL database is fine for logging trades, a time-series database like InfluxDB or TimescaleDB is purpose-built for this job. These are optimised for storing and querying huge amounts of timestamped data—think price ticks or order book snapshots—which makes backtesting and performance analysis significantly faster.

Second, for any high-frequency system, managing the data flow is a huge challenge. A messaging queue like Apache Kafka or RabbitMQ acts as a central nervous system for your bot. It decouples your data producers (e.g., WebSocket connections) from your data consumers (the strategy engines). This creates a resilient buffer that prevents data loss during traffic spikes and lets different parts of your system operate at their own pace.

How to Handle Exchange APIs and Real-Time Data

A trading bot is blind and deaf without a solid connection to the market. This connection is its lifeline, feeding it the real-time data needed to spot opportunities and execute trades. Your success in crypto trading bot development really hinges on getting these exchange integrations right. This involves mastering both REST APIs for actions and WebSockets for continuous data streams.

How Do You Manage Exchange API Connections?

Every crypto exchange offers a REST API for programmatic trading, but they are far from standardized. Each has its own authentication methods, endpoint structures, and—most importantly—rate limits. Violating these limits can result in a temporary or permanent IP ban, taking your bot offline.

Effective rate limit management is non-negotiable. The best practice is to build a centralized API client that funnels all requests through a single module. This module tracks outgoing calls and automatically queues or throttles requests to stay within the exchange’s allowed limits, preventing costly interruptions.

Building for resilience is equally critical. Exchange APIs can fail, return unexpected errors, or go down for maintenance. Your bot must include robust error-handling and retry logic with exponential backoff to gracefully manage these temporary disruptions without crashing.

How Do You Support Multiple Exchanges?

A common mistake is tightly coupling a bot’s logic to a single exchange’s API structure. This creates a massive technical debt when you want to add support for a new exchange. The solution is to create a normalized data layer, which acts as a universal translator.

This layer takes the unique data format from any exchange and converts it into a standardized internal format that your strategy engine understands. For example, whether an exchange calls a trade ‘price’ or ‘last_price,’ your internal model always sees it as trade.price.

This design offers two key advantages:

- Flexibility: Adding a new exchange only requires writing a new adapter, not rewriting your core logic.

- Maintainability: Your trading strategies remain clean and independent of any single exchange’s quirks.

How to Process High-Speed WebSocket Feeds

While REST APIs are for taking action, WebSockets are for observation. They provide a persistent, real-time firehose of market data—every single trade, tick, and order book update. Taming this data stream is a core challenge in building a high-performance bot.

Your bot needs an efficient parser to process incoming WebSocket messages, check their integrity, and update its internal state of the market, such as the live order book. For bots that touch DeFi protocols, understanding the principles behind building decentralized exchanges can offer invaluable insight into how these real-time data feeds and API interactions work under the hood.

Expert Insight: Maintaining an accurate, in-memory order book is one of the toughest parts of managing WebSocket data. You must handle sequence numbers perfectly to ensure updates are never processed out of order. A single mistake could lead your bot to make decisions based on a corrupted or “ghost” view of the market.

How Do You Implement Trading Strategies and Risk Controls?

The core logic of your crypto trading bot transforms raw market data into profitable action. However, a profitable strategy without rock-solid risk controls is a ticking time bomb. Effective crypto trading bot development weaves strategy and risk management together from the very first line of code.

What Are the Most Common Trading Strategies?

A versatile bot should be able to switch between strategies based on market conditions. Here are three foundational models:

- Market-Making: This strategy profits from the bid-ask spread by placing simultaneous buy (bid) and sell (ask) orders, providing liquidity to the market. It is a high-volume, low-margin game that thrives in stable, liquid markets.

- Trend-Following: This approach uses technical indicators like moving averages (e.g., the 50-day and 200-day crossover) or the Relative Strength Index (RSI) to identify and ride an established market trend until it shows signs of reversal.

- Triangular Arbitrage: This complex strategy exploits tiny price discrepancies for a single asset across three different currency pairs (e.g., BTC/USDT, ETH/BTC, and ETH/USDT). It involves executing a rapid sequence of trades to capture risk-free profit from fleeting market inefficiencies, demanding extremely low latency.

Expert Insight: Don’t try to boil the ocean. Start with a single, well-understood strategy like trend-following. Master one strategy, prove it’s profitable in paper trading, and then start expanding your bot’s arsenal.

How Do You Embed Risk Controls?

Risk controls are the guardrails that prevent your bot from driving your capital off a cliff during a market crash. They are non-negotiable and must be built directly into your bot’s logic.

- Position Sizing: Never go all-in on one trade. Implement a hard rule limiting any single position to a small fraction of your total portfolio, typically 1-2%.

- Stop-Loss Orders: This is your eject button. The moment your bot enters a position, it must automatically place a stop-loss order to define the maximum acceptable loss.

- Kill Switch: A manual or automated trigger that instantly liquidates all open positions and freezes trading activity. This is your last line of defence against a rogue bug or an unforeseen “black swan” market event.

How Do You Validate a Trading Strategy?

Before deploying real capital, you must validate your logic against historical data through backtesting. This simulates how your strategy would have performed in past market conditions.

Beware of overfitting, where a strategy is tuned so perfectly to historical data that it fails in live trading. To avoid this, always split your data into a training set (for development) and a validation set (for testing).

After successful backtesting, proceed to paper trading (sandbox trading). This runs your bot in a live market with a simulated account, exposing it to real-world challenges like API latency, slippage, and exchange downtime—factors that backtesting cannot fully replicate. A strategy’s success often hinges on how it reacts to real-time price action. Our article on a unified trading prediction platform dives deeper into how to turn raw price movements into actionable probabilities.

How to Deploy and Optimize Your Trading Bot

Taking a bot from a controlled testing environment to a live, production-grade system introduces new challenges where security, reliability, and speed are paramount. This phase requires a shift from a developer mindset to a robust DevOps one, ensuring your bot runs securely 24/7.

How Do You Ensure High Availability?

To achieve the reliability needed for 24/7 trading, modern DevOps practices are essential. The first step is to containerize your application using tools like Docker. Docker packages your bot and all its dependencies into a single, portable unit, eliminating the “it worked on my machine” problem and providing a consistent environment.

Once containerized, use an orchestrator like Kubernetes (K8s) to automate deployment, scaling, and management. Kubernetes can automatically restart a crashed bot, scale resources during market volatility, and roll out updates with zero downtime, ensuring high availability.

How to Secure Your Bot in Production

In the world of digital assets, security is everything. API keys are the literal keys to your exchange funds and must be guarded obsessively.

Never hardcode API keys or other secrets directly into your code. Instead, use a dedicated secrets management tool like HashiCorp Vault. Vault provides a secure, centralized location to store and control access to tokens, passwords, and API keys, which your bot can fetch at runtime.

Expert Insight: Always apply the principle of least privilege to your API keys. When generating them on an exchange, grant only the permissions your bot absolutely needs. If it only needs to trade, do not grant it withdrawal permissions. This simple step can prevent a catastrophic loss.

Continuous monitoring is your next line of defence. Tools like Grafana and Prometheus allow you to build real-time dashboards to track key metrics like system health (CPU, memory), application performance (API latency, error rates), and financial metrics (PnL, open positions).

How to Tune for Peak Performance

In algorithmic trading, milliseconds matter. Performance tuning is a continuous process of optimizing your system for speed.

One of the most significant gains comes from reducing network latency by co-locating your servers in a data center physically close to the exchange’s servers. This drastically cuts the round-trip time for your API calls.

Beyond networking, continuously profile your application to identify performance bottlenecks, optimize slow database queries, and ensure your data processing pipelines are lightning-fast. Every optimization adds up, giving your bot the edge it needs to capitalize on market opportunities the moment they appear.

How Blocsys Accelerates Your Trading Bot Development

Building a competitive crypto trading bot requires a rare mix of expertise in high-frequency trading systems, blockchain technology, financial strategy, and ironclad security. Blocsys specializes in delivering these complex, mission-critical solutions, bridging the gap between a promising strategy and a profitable, secure, automated trading platform.

Our development teams are not just generalists; they’re specialists fluent in high-performance languages like Go and Rust. We have deep experience applying AI for predictive analytics, building bots engineered from the ground up for speed and precision. Whether you’re targeting DeFi protocols or centralized exchanges, we design solutions built around your unique strategies.

From Concept to Production Faster

Building a production-grade crypto trading bot from scratch is a massive undertaking, often leading to costly delays and technical hurdles.

We accelerate your time-to-market by leveraging our library of battle-tested components and pre-built modules for core functions like exchange integration, risk management, and data normalization. This allows us to focus our energy on what makes your bot unique—your proprietary trading logic.

By integrating our robust DevSecOps practices from day one, we ensure your platform is not only built quickly but is also secure and scalable. This means your bot is production-ready, capable of handling market volatility without compromising on performance or safety.

Flexible Engagement Models for Your Needs

We understand that every project is unique. Whether you need an end-to-end partner or specific skills to augment your in-house team, Blocsys offers flexible engagement models to fit your situation:

- End-to-End Project Delivery: We take full ownership of the development lifecycle, from initial architecture and design through deployment and ongoing maintenance.

- Team Augmentation: We embed our expert developers directly into your existing team, perfect for filling targeted skills gaps in areas like Rust development, low-latency infrastructure, or smart contract integration.

This flexibility ensures you get the precise expertise you need, exactly when you need it. Learn more about our approach to IT resource augmentation.

Ultimately, our goal is to provide the specialized knowledge and engineering power you need to build a competitive and profitable trading solution. We handle the complex technical foundations, freeing you up to focus on what you do best: refining your strategies and growing your business.

Frequently Asked Questions

What Is the Best Programming Language for a Crypto Trading Bot?

There’s no single “best” language; the right choice really hinges on what you’re trying to achieve. From my experience, Python is unbeatable for rapid prototyping and backtesting. Its rich ecosystem of data science libraries lets you test out and validate strategies incredibly quickly.

But when every microsecond counts, especially in high-frequency trading, you need more horsepower. That’s where a language like Go (Golang) shines. It’s built for concurrency, making it fantastic at juggling multiple data streams and API connections without breaking a sweat. For the most demanding, low-latency applications where speed and memory safety are non-negotiable, Rust is the top contender, though it comes with a much steeper learning curve.

How Do You Keep a Trading Bot Secure?

Security isn’t a single feature; it’s a multi-layered mindset. It all starts with your API credentials. You should never hardcode keys directly into your source code. Instead, use a proper secrets management tool like HashiCorp Vault to securely inject them at runtime.

Beyond that, you need to lock things down at the exchange level. Always restrict API key permissions—disable withdrawal capabilities and whitelist the specific IP addresses your bot will operate from. On the infrastructure side, basic hygiene like firewalls, running inside private networks, and continuous monitoring are essential for spotting any strange activity. Finally, make regular code audits a part of your process to catch vulnerabilities before they become a real problem.

What Are the Biggest Challenges in Building a Trading Bot?

One of the toughest hurdles is dealing with unreliable exchange APIs. They can go down, return inconsistent data, or hit you with aggressive rate limits, especially when the market gets chaotic. Building a bot that can gracefully handle these interruptions without crashing is a massive engineering challenge.

Another common pain point is processing high-velocity market data from WebSocket feeds without introducing latency, which demands a highly optimised architecture. And perhaps the most persistent challenge is designing and rigorously backtesting your risk management logic. Avoiding flawed strategies and preventing overfitting is what separates the bots that make money from the ones that blow up accounts.

How Much Does Custom Crypto Trading Bot Development Cost?

The cost can vary wildly depending on the bot’s complexity. A straightforward bot running a single strategy on one exchange might be built for under $10,000.

However, an enterprise-grade platform is a whole different ball game. If you’re looking for a system with a custom user interface, integrations with multiple exchanges, advanced analytics, and a high-availability infrastructure, the investment can easily range from $50,000 to over $100,000. The final price tag really boils down to the specific strategies, security measures, and scalability you need.

Building a high-performance, secure, and profitable crypto trading bot requires deep expertise across blockchain, financial systems, and secure infrastructure. Blocsys specialises in delivering these complex solutions, from high-frequency bots in Rust and Go to AI-driven predictive platforms.

Whether you need an end-to-end build or expert developers to augment your team, we provide the specialised skills to accelerate your launch and build a competitive trading solution.

Ready to build a trading bot that performs? Schedule a consultation with our experts today.