Decentralized exchange development services are the end-to-end partnerships that build, launch, and secure peer-to-peer trading platforms. Unlike traditional crypto exchanges, these services focus on a non-custodial architecture, meaning users retain full control of their funds. For organizations in Web3, crypto, and finance, this guide explains how these services work, what to look for in a partner, and how to build a platform that is secure, compliant, and ready for the future. The outcome is a clear decision-making framework for your DEX project.

What Are Decentralized Exchange Development Services?

Decentralized exchange development services provide the specialized expertise needed to architect a secure, scalable, and market-ready Decentralized Exchange (DEX). This comprehensive engagement covers everything from initial strategy and tokenomics design to smart contract engineering, rigorous security audits, and post-launch support. For both fintech startups and established financial institutions, these services are the bridge to launching a Web3 financial ecosystem.

The core value is creating a platform where trades execute directly between user wallets, governed by immutable smart contracts. With no central intermediary holding funds, the system removes counterparty risk and builds a foundation of trust.

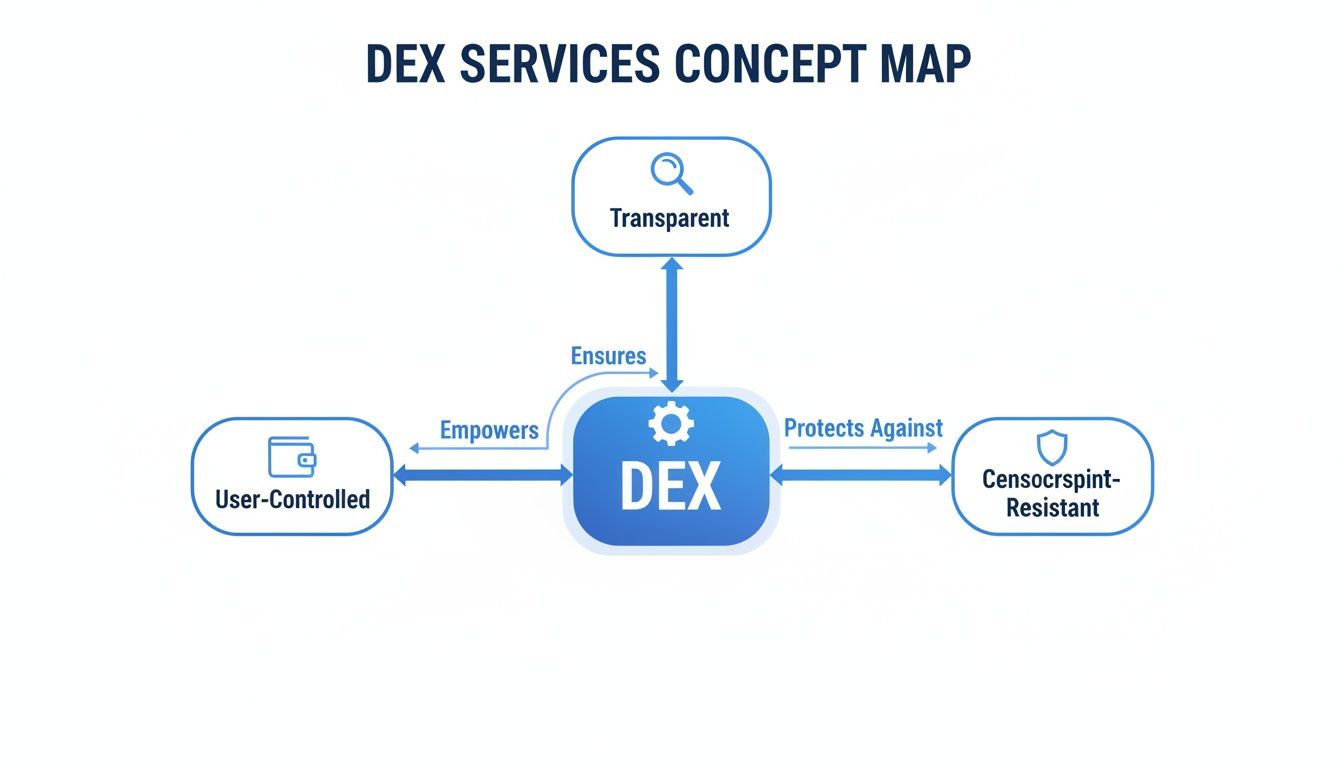

Core Principles and Value Proposition

The primary goal of any DEX is to build a trading environment grounded in the core principles of decentralization. Professional development services ensure these values are integrated into the platform’s architecture from the start.

- User Sovereignty (Non-Custodial Wallets): Users connect their own wallets, like MetaMask or Trust Wallet, and never relinquish control of their private keys. This eliminates the counterparty risk seen in centralized exchanges, which are frequent targets for large-scale hacks.

- On-Chain Transparency: Every transaction is recorded on a public blockchain ledger. This creates an immutable audit trail where anyone can verify trade volumes, liquidity pools, and protocol fees, fostering deep trust within the user base.

- Censorship Resistance: Because no single entity controls the platform or the funds locked within it, a DEX is inherently resistant to shutdowns or asset freezes. This resilience makes it a vital tool for users in regions with unstable financial or political systems.

In essence, decentralized exchange development services are for organizations aiming to build financial infrastructure that is open, permissionless, and community-governed. The objective isn’t just to build a trading platform; it’s to construct a system aligned with the ethos of blockchain technology—empowering individuals by removing intermediaries. This is a strategic decision that positions a platform for long-term relevance in the evolving digital economy.

Which DEX Architecture is Right for You: AMM vs Order Book?

A fundamental decision in DEX development is choosing the core trading mechanism: the Automated Market Maker (AMM) or the classic Order Book. This architectural choice defines the user experience, liquidity management, and overall platform strategy. An AMM acts like an automated currency exchange, always ready to provide a price based on its asset reserves. In contrast, an Order Book functions like a traditional stock market, matching individual buy and sell orders.

Selecting the right model is a critical first step when engaging with decentralized exchange development services. While the mechanics differ, both architectures are built on the principles of user control, operational transparency, and censorship resistance.

This foundation ensures the system is designed to empower its users, regardless of the underlying technology.

The Automated Market Maker (AMM) Model

The AMM model, popularized by platforms like Uniswap, revolutionized DeFi by using liquidity pools and a mathematical formula to determine asset prices. Instead of matching buyers and sellers, users trade against a pool of token pairs supplied by other users, guaranteeing constant liquidity.

- How it Works: A user trades directly with the smart contract managing the liquidity pool. For example, in an ETH/USDC pool, selling ETH adds ETH to the pool and removes USDC, with the algorithm instantly recalculating the price based on the new asset ratio.

- Liquidity Provision: Anyone can become a liquidity provider (LP) by depositing an equal value of both tokens into a pool. In return for providing capital, LPs earn a share of the trading fees generated by that pool.

- Key Challenge – Impermanent Loss: This is a risk unique to AMMs. It occurs when the price of deposited tokens changes relative to their value if simply held in a wallet. If one asset’s price rises significantly, an LP may withdraw a less valuable mix of assets, creating a potential opportunity cost.

The simplicity of AMMs has driven their adoption, especially in emerging markets. India’s DeFi ecosystem, for instance, has seen explosive growth, with DeFi accounting for 56% of transaction volume in the Central and Southern Asia and Oceania region from mid-2022 to mid-2023. This demand fuels the need for accessible, AMM-based platforms capable of handling significant volume.

The Order Book Model Explained

The Order Book model mirrors traditional stock and crypto exchanges. It is a digital ledger of all open buy (“bid”) and sell (“ask”) orders for an asset, organized by price. This structure provides deep market transparency and enables more sophisticated trading strategies. An order book matches a buyer’s bid with a seller’s ask at the same price, a process driven entirely by supply and demand.

The primary advantage of an order book DEX is its efficiency and precision, making it the preferred choice for professional traders. It allows for advanced order types like limit orders and stop-losses, which most AMMs cannot handle natively.

However, operating a full order book on-chain can be slow and expensive due to gas costs for every action (placing, canceling, or filling an order). To overcome this, many platforms use a hybrid model: the order book operates off-chain for speed, while final trade settlement occurs on-chain for security. For a deeper analysis of on-chain performance, refer to our guide on the impact of Layer 2 solutions on blockchain scalability.

How Do You Make the Right Architectural Choice?

The choice between an AMM and an Order Book depends on your project’s goals, target audience, and chosen blockchain. This decision is where an experienced decentralized exchange development services partner provides critical strategic guidance.

AMM vs Order Book DEX Models Compared

This foundational decision shapes your entire platform. An AMM prioritizes simplicity and guaranteed liquidity, making it ideal for retail users and new tokens. An Order Book delivers the precision and control professional traders demand. This table provides a side-by-side comparison.

| Feature | Automated Market Maker (AMM) | Order Book DEX |

|---|---|---|

| User Experience | Simple and intuitive; ideal for beginners. | More complex and feature-rich; suited for experienced traders. |

| Liquidity | Always available, but large trades can cause high slippage. | Can be thin, leading to wide bid-ask spreads if demand is low. |

| Order Types | Mostly market swaps. Limit orders require additional layers. | Natively supports advanced orders like limit and stop-loss. |

| On-Chain Cost | Generally lower, as a simple swap is a single transaction. | Can be high due to frequent order creation and cancellation. |

| Ideal Use Case | Long-tail assets and retail-focused swapping platforms. | High-volume assets, professional trading platforms, perpetuals. |

Ultimately, if your goal is frictionless swapping for a wide array of tokens, an AMM is an excellent choice. If you’re building a platform for serious traders who require precision and advanced tools, an Order Book is the superior option.

How to Integrate Security and Compliance into Your DEX

In the digital asset industry, trust is the entire product. For any ambitious DEX project, integrating robust security and intelligent compliance from day one is non-negotiable. This requires a proactive, defense-in-depth strategy to protect user funds and build a lasting reputation. A security-first approach embeds protection into every stage of development, separating enduring platforms from cautionary tales.

How Do You Fortify Your DEX Against Threats?

The core of a DEX is its smart contracts, which govern all platform logic and hold user funds. A single vulnerability can lead to catastrophic failure, making meticulous auditing essential. A professional decentralized exchange development services provider advocates for multiple, independent audits from reputable third-party firms. This layered approach ensures different expert teams scrutinize the code, drastically increasing the chance of catching subtle bugs like re-entrancy attacks before exploitation.

Beyond smart contracts, the entire platform infrastructure must be hardened. To protect users and meet industry standards, you must implement robust and automated data security and compliance pentests. Penetration testing simulates real-world attacks on your front-end, APIs, and backend servers to identify and fix weaknesses before malicious actors can find them.

Key security measures must include:

- Multiple Smart Contract Audits: Engaging at least two independent auditing firms to stress-test the codebase.

- Comprehensive Penetration Testing: Actively attempting to breach the platform’s defences to find and fix security gaps in web applications and network infrastructure.

- Bug Bounty Programs: Incentivizing the global community of security researchers to discover and responsibly disclose vulnerabilities.

- Secure Development Lifecycle (SDL): Integrating security checks and code scanning throughout the entire development process, not just at the final stage.

This multi-faceted security posture creates layers of defense that work in concert, making the platform exponentially more resilient.

How Do You Navigate the Global Compliance Maze?

While security ensures technical integrity, compliance addresses the complex and fragmented world of global regulations. A globally operational DEX must be designed for adaptability. The architecture needs to be flexible enough to accommodate different regional rules without compromising its core decentralized principles.

India’s booming crypto market provides a clear example. The country recorded ₹51,000 crore ($6.12 billion) in crypto transactions in the 2024-25 fiscal year, indicating massive regional demand. Simultaneously, the government imposes a 1% Tax Deducted at Source (TDS) on every crypto transaction. A DEX targeting this market must have a built-in mechanism to track and report these deductions—a compliance requirement that must be engineered into the platform’s core.

Designing for compliance means building a system that can selectively apply regional rules. This may involve a modular architecture where specific compliance features can be enabled or disabled based on user jurisdiction, ensuring the platform remains globally accessible while respecting local laws.

This adaptive approach is vital for long-term survival. As regulatory frameworks shift worldwide, a DEX built with modular compliance can adapt without requiring a complete overhaul. This foresight distinguishes a professionally developed platform and ensures it can attract not only retail users but also institutional capital that demands regulatory clarity.

What is the DEX Development Lifecycle from Concept to Launch?

Bringing a decentralized exchange (DEX) to market is a structured journey, not a chaotic sprint. Professional decentralized exchange development services follow a clear, phased lifecycle that transforms a high-level vision into a secure, production-ready platform. Each stage builds upon the last, ensuring strategic, technical, and design elements are perfectly aligned for market launch. This transparent roadmap demystifies the process, providing a clear view of activities and deliverables at every step.

Phase 1: Discovery and Strategy

This initial phase is the most critical, laying the project’s entire foundation. It moves beyond the simple idea of “building a DEX” to define what makes your platform unique. The goal is to establish a crystal-clear product vision and technical strategy.

Key activities include:

- Defining the Unique Value Proposition (UVP): What specific problem are you solving? Who is your target audience—retail traders, institutional clients, or a niche crypto community?

- Tokenomics Design: If launching a native token, this involves architecting its utility, supply mechanics, and incentives to fuel platform growth and guide governance.

- Technical Architecture Planning: This is where key decisions are made: AMM or order book? Which blockchain will you launch on? What is the plan for future cross-chain support?

The main deliverable is a detailed product requirements document (PRD) and a technical specification that serves as the blueprint for the entire project.

Phase 2: UI and UX Design

With a solid strategy, the focus shifts to creating an intuitive and engaging user experience. In DeFi, complexity is a major barrier to entry, making a clean, seamless interface non-negotiable. The objective is to make trading, providing liquidity, and managing a portfolio feel straightforward.

This creative stage involves:

- User Flow Mapping: Charting every step a user takes, from connecting their wallet to executing a trade.

- Wireframing and Prototyping: Building low-fidelity sketches and then high-fidelity interactive models to test usability and refine the user journey before coding begins.

- Visual Design: Developing a compelling brand identity and user interface that not only looks professional but also builds trust and credibility.

The result is a complete set of design files and a clickable prototype, ensuring alignment on the final look and feel. For related design concepts, explore our guide on creating a modern crypto trading platform.

Phase 3: Engineering and Development

This phase brings the plans and designs to life. Development is typically split into two parallel streams: on-chain smart contracts and off-chain supporting infrastructure.

- Smart Contract Development: Engineers write, test, and secure the on-chain logic governing all core functions—swaps, liquidity pools, staking, and more. This code is immutable once deployed, demanding absolute precision.

- Backend and Frontend Engineering: The backend team builds the server-side infrastructure, APIs, and data indexing services. Simultaneously, the frontend team develops the responsive, user-facing application based on the approved UI/UX designs.

A security-first mindset is embedded throughout this phase. Regular code reviews, adherence to best practices, and automated security tools are integrated directly into the development workflow to minimize vulnerabilities from the start.

Phase 4: Testing and Deployment

Before launch, the platform undergoes a multi-faceted and rigorous testing process to ensure it is secure, reliable, and performs under pressure. This is the final quality gate.

The critical steps here are:

- Internal Quality Assurance (QA): The internal team conducts extensive functional, performance, and integration testing to identify bugs and usability issues.

- Third-Party Security Audits: Multiple independent, reputable auditing firms are engaged to scrutinize the smart contract code for potential vulnerabilities. This external validation is essential for building user trust.

- Mainnet Deployment: Once audits are passed and final tests are cleared, the smart contracts are deployed to the mainnet and the platform is launched. Post-launch monitoring and support are activated immediately to ensure a smooth transition.

What are the Essential Features for a Modern DEX?

In today’s competitive DeFi market, a basic token swap function is merely table stakes. To attract and retain users, a modern decentralized exchange (DEX) requires a rich feature set that delivers value, simplifies the user experience, and anticipates the future of finance. Building these capabilities requires a deep understanding of both market demands and the technology needed to implement them. A winning platform becomes a comprehensive financial hub, not just a simple swap tool.

Core Capabilities for a Competitive Edge

To build a DEX that stands out, several key features are now considered essential. Integrating them requires careful planning and expert execution from your development partner.

- Cross-Chain Support: The blockchain ecosystem is multi-chain. A DEX limited to a single network restricts its user base and liquidity. By implementing cross-chain bridges or atomic swaps, you enable users to trade assets seamlessly across different blockchains, tapping into a much larger pool of capital and users.

- Fiat On-Ramps and Off-Ramps: The biggest hurdle for DeFi newcomers is converting fiat currency into crypto. Integrated fiat on-ramps allow users to purchase digital assets directly on the DEX with a credit card or bank transfer, dramatically simplifying the onboarding process and broadening your potential audience.

- Advanced Trading Tools: While AMMs are valued for their simplicity, sophisticated traders require more control. Adding features like limit orders, stop-loss orders, and detailed charting tools caters to this power-user segment, adding a layer of functionality that builds platform loyalty.

A forward-thinking DEX is built not just for today’s market but for the financial landscape of tomorrow. The ability to integrate emerging technologies and asset classes is what ensures long-term relevance and growth.

Future-Proofing with Advanced Integrations

Looking beyond the basics, the next generation of DEXs will be defined by their integration of innovative technologies to expand user capabilities and unlock new markets. This is where professional decentralized exchange development services provide immense strategic value.

One of the most promising frontiers is the integration of Artificial Intelligence (AI). AI-powered tools can offer users predictive analytics, automated trading strategies, and intelligent liquidity provision, helping them optimize returns and navigate complex market decisions. Imagine an AI agent analyzing on-chain data and market sentiment to suggest optimal trading opportunities.

Another critical trend is bringing Real-World Assets (RWAs) on-chain, which involves tokenizing assets like real estate, commodities, or private equity. A DEX capable of handling RWAs opens itself to trillions of dollars in traditional market value, placing it at the forefront of a major financial evolution. This requires specialized expertise in creating and managing compliant, asset-backed tokens.

To better understand how external data powers such systems, you may find our article on the power of Chainlink oracles in blockchain insightful.

By focusing on both essential and forward-looking features, you can build a DEX that is not only competitive today but is also positioned to lead the future of decentralized finance.

How to Choose Your DEX Development Partner

Selecting the right firm for your decentralized exchange development is one of the most critical decisions you will make. This choice directly impacts your platform’s security, scalability, and time-to-market. An expert partner translates your vision into a robust system, whereas an inadequate one can lead to critical security flaws and costly delays. Making the right choice requires a clear framework for evaluating a firm’s real-world expertise, proven track record, and technical depth.

How Do You Evaluate Technical Expertise and Portfolio?

First, you must verify hands-on experience in the DeFi space. A strong, verifiable portfolio is a necessity, not a bonus. Look for launched projects that are live and operational. Investigate their on-chain activity, test their user interfaces, and assess their overall performance.

Key questions to ask potential partners include:

- Architectural Proficiency: Can they provide specific case studies for the DEX model you want to build? Whether it’s an AMM, a high-frequency order book, or a hybrid, they need to demonstrate proven experience.

- Multi-Chain Experience: Have they successfully deployed platforms on different blockchains like Ethereum, Solana, or BNB Chain? This indicates adaptability and a deep understanding of various crypto ecosystems.

- Security and Audit History: Request evidence of their smart contract auditing process. Any reputable partner will have a history of collaborating with top-tier third-party audit firms and will be transparent about their security protocols.

How Do You Assess Engagement Models and Post-Launch Support?

Beyond technical skill, you need a partner whose working style and long-term vision align with yours. A DEX is a dynamic platform that requires ongoing maintenance, security updates, and feature enhancements to remain competitive.

It is also crucial to understand their engagement models. Discuss the pros and cons of managed services vs. staff augmentation to determine the best fit for your project. A dedicated team may offer deeper integration, while a managed service provides a more hands-off approach.

A partner’s grasp of regional market dynamics can be a game-changer. Take India, for example. The country has an estimated 100 million crypto users, yet regulatory limbo has pushed around ₹5 lakh crore ($5 trillion) in trading volume to offshore exchanges. A partner who sees this can help build a compliant, local DEX designed to capture that massive opportunity. You can read a full analysis on India’s crypto volume versus its policy silence.

Ultimately, you are not just hiring developers; you are seeking a strategic partner who understands both the technology and the market. They should provide a clear roadmap for post-launch support, including service-level agreements (SLAs) for uptime, security monitoring, and future upgrades. This ensures your platform not only launches successfully but thrives for years to come.

Frequently Asked Questions

Here are concise answers to the most common questions about decentralized exchange development.

How Long Does It Take to Build a Decentralised Exchange?

Building a robust decentralized exchange typically takes 4 to 8 months. A straightforward AMM-based DEX falls on the shorter end of this range, while a custom, cross-chain order book platform with multiple security audits will require a longer timeline. The total duration depends on the project’s complexity, features, and the rigor of the testing and auditing phases.

What Are the Main Costs in DEX Development?

The primary cost drivers in DEX development are elite engineering talent, comprehensive security audits, and architectural complexity. Experienced blockchain developers command high salaries, and skimping on third-party security audits is not an option when user funds are at stake. Features like cross-chain support, a custom matching engine, or advanced protocol integrations also increase development hours and overall costs.

For a quicker market entry, a white-label DEX can cost between $25,000 to $90,000. In contrast, a fully custom platform with unique features and uncompromising security generally starts at $175,000 and can extend into the millions for institutional-grade systems.

What Is the Difference Between Custodial and Non-Custodial Exchanges?

The key difference is control over funds. Custodial exchanges (most centralized platforms) hold your private keys and assets on your behalf, requiring you to trust a third party. Non-custodial exchanges, the standard for DEXs, are designed so you always retain full control of your private keys and assets. Trades execute directly from your wallet via smart contracts, eliminating counterparty risk.

Engaging professional decentralized exchange development services ensures this non-custodial model is securely implemented, empowering users and aligning the platform with the core ethos of blockchain technology.

At Blocsys Technologies, we specialize in engineering the secure, scalable, and compliance-aware financial infrastructure that powers next-generation markets. Whether you’re building a cross-chain DEX, a real-world asset tokenization platform, or AI-assisted trading systems, our expert team provides the end-to-end execution needed to move from concept to a production-ready system.

Connect with our experts today to discuss your project requirements.