In today’s dynamic digital economy, the tokenization of real-world assets is no longer a fringe concept; it’s quickly becoming a cornerstone of modern investment strategies and enterprise innovation. For business leaders, investors, VCs and web investors eyeing high-growth opportunities across the asset-token landscape, one standard stands out: ERC-7943.

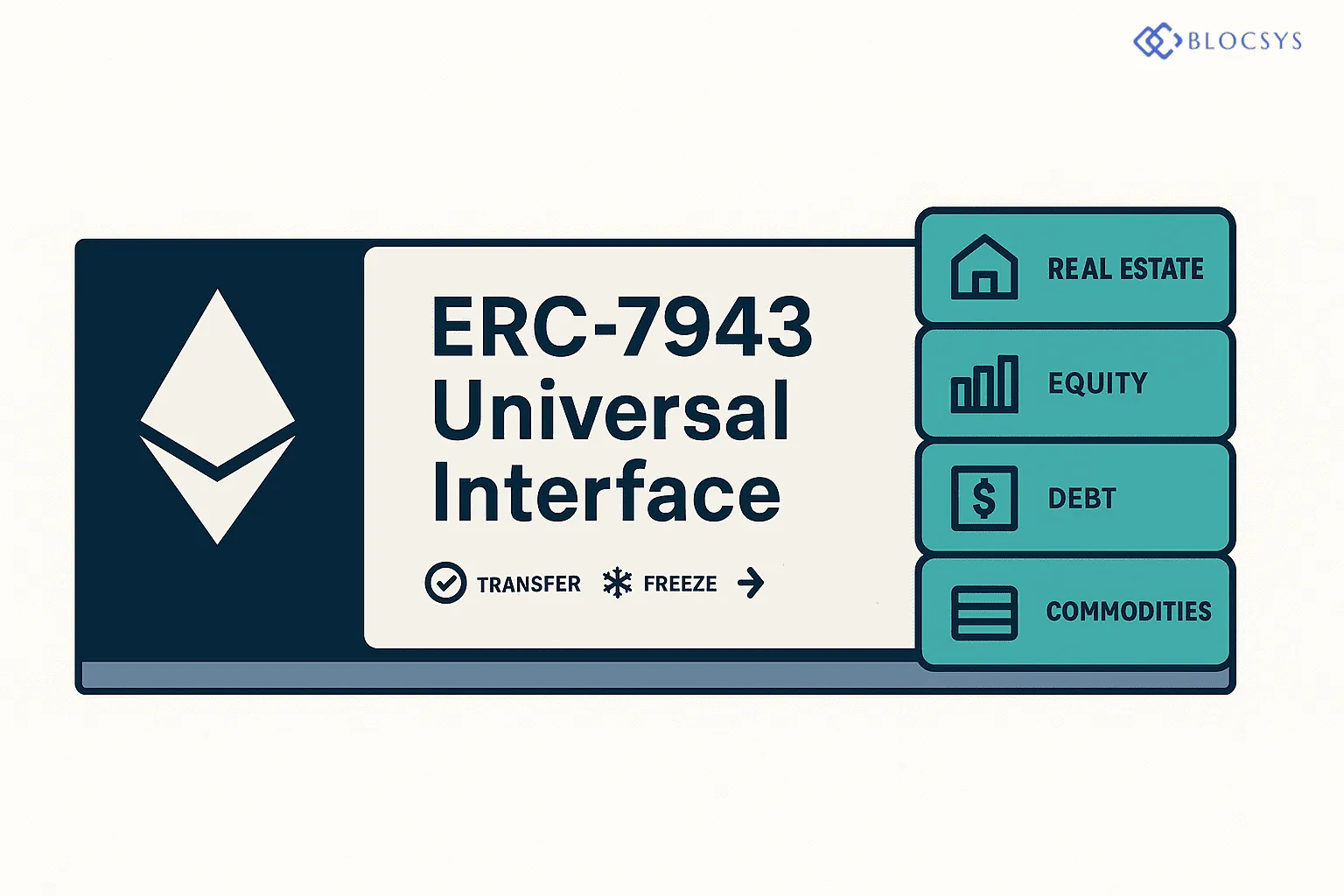

In this deep-dive blog, we’ll explore why ERC-7943 is set to disrupt how assets such as real estate, equity, debt, commodities and more are represented in the blockchain era. We’ll cover what the standard is, why it matters, how it works and what opportunities (and risks) it presents for your organisation or portfolio.

What is ERC-7943?

A new token standard proposed on the Ethereum blockchain, ERC-7943 (also known as the “uRWA – Universal Real World Asset Interface”), provides a minimal, implementation-agnostic interface for tokenized real-world assets (RWAs).Here’s the essential List:

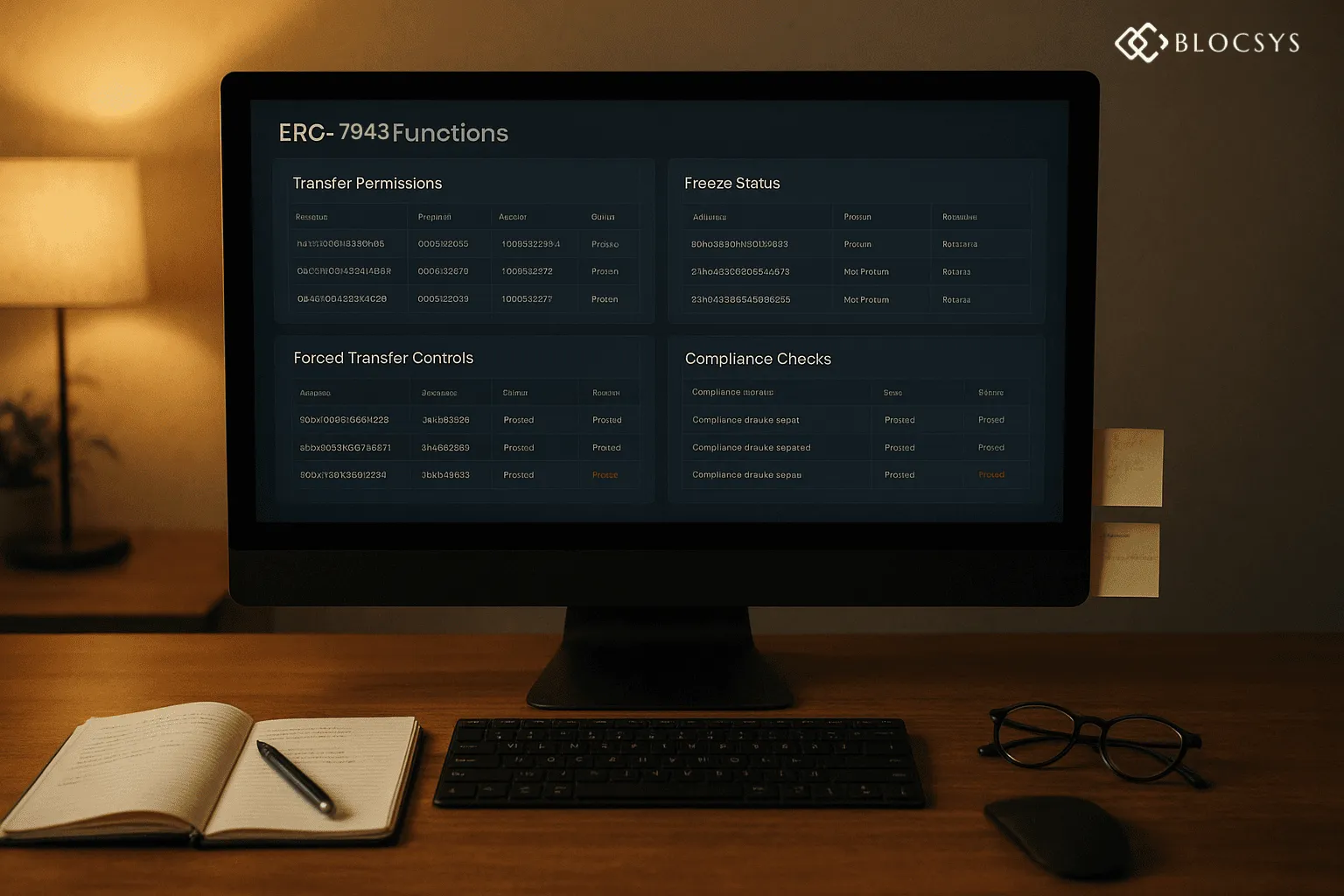

- The standard defines core compliance and control functions such as canTransfer, forcedTransfer, and getFrozenTokens. These are functions that any RWA token should support.

- It is intentionally minimal: the standard does not impose how those functions are implemented or enforce specific identity/KYC protocols

- It is designed to be highly compatible – it can layer on top of tokens built on ERC-20, ERC-721 or ERC-1155.

In very simple terms: ERC-7943 is a “common denominator” for tokenized real-world assets, enabling developers and institutions to build with shared building blocks rather than reinventing compliance logic for each asset type.

Key Features Of ERC-7943

The minimal, universal, compliance-focused interface for tokenized real-world assets, ERC-7943 (uRWA – Universal Real-World Asset Interface), can sit on top of ERC-20, ERC-721, or ERC-1155.

Core Features

Minimal, implementation-agnostic design – provides essential RWA functions without dictating how they must be implemented.

Built-in compliance controls, including:

- canTransfer / isUserAllowed – checks if transfers are allowed under compliance rules.

- forcedTransfer – lets authorised parties enforce transfers (e.g., regulator/court orders).

- getFrozenTokens / setFrozenTokens – supports freezes, lock-ups, regulatory holds and escrow.

- Fully compatible with existing token standards, enabling fungible, NFT, and semi-fungible tokens to use the same RWA interface.

- Reduces fragmentation by acting as a common denominator across tokenization platforms, eliminating proprietary or custom compliance modules.

- Institution-friendly via enforcement, freeze logic and transfer-restriction hooks that traditional token standards lack.

- It is modular and future-proof, and you can add identity, metadata, and jurisdiction-specific rules as optional extensions.

- Improves interoperability across tokenization platforms and secondary markets by offering a unified interface for listing and compliance checks.

- Supports scaling and liquidity, enabling multi-asset marketplaces to adopt one shared standard.

Why ERC-7943 Matters for Business & Investment

For business executives, investors and web-investors, ERC-7943 presents compelling themes:

-

Improved Interoperability & Reduced Fragmentation

The real-world asset tokenization space has been plagued by fragmentation of various protocols, custom token standards, proprietary compliance modules, vendor lock-in. ERC-7943 directly addresses this by offering a vendor-agnostic, modular interface that aims to unify diverse RWA implementations.

-

Institutional-Grade Compliance Nervousness

Institutions require strong controls: asset freeze/unfreeze, forced transfers, transfer restrictions, regulatory compliance. Many existing token-standards didn’t bake these in. ERC-7943 includes the essential compliance hooks, offering a bridge between institutional requirements and blockchain innovation.

-

Growth in the RWA Market

The tokenized real-world asset market is already sizable and growing. One recent figure shows over US$28 billion in tokenized RWAs, with growth continuing month-on-month. As blockchain meets real-world finance, being early in a utilitarian standard like ERC-7943 could yield first-mover advantages.

-

Build-once, deploy-many

For software development firms and service providers working on tokenization platforms, a standardised interface means you can build solutions once (that comply with ERC-7943), then reuse them across asset classes, jurisdictions and clients, saving time, reducing cost, and accelerating go-to-market.

-

Investor thesis & differentiation

For VCs/web investors looking at platforms, protocols or service providers in the tokenization ecosystem: partners that adopt ERC-7943 may signal strong ambition toward institutional readiness, interoperability and scalability. That can enhance value-proposition and differentiation.

Blocsys Technologies Insights on the ERC-7943

Blocsys Technologies is a next-generation blockchain development company specializing in enterprise-grade predication marketplace, Crypto trading platform development, DeFi Marketplace development, tokenization, decentralised identity, smart-contract development, and regulatory-ready Web3 infrastructure. The company helps financial institutions, startups, and global enterprises build scalable, secure, interoperable blockchain solutions with a strong focus on real-world asset tokenization (RWA) compliance frameworks make them future proof. Following are insights on ERC-7943:

- ERC-7943 is a breakthrough step toward unified RWA compliance, reducing the fragmentation currently seen across tokenization platforms.

- The minimal, implementation-agnostic design aligns perfectly with enterprise needs, allowing institutions to integrate compliance controls without being locked into proprietary systems.

- ERC-7943 accelerates tokenization adoption by enabling developers to build once and scale across multiple asset classes.

- It enhances interoperability, making it easier for platforms, wallets, and secondary markets to support tokenized assets without customizing logic for every issuer.

- The standard’s compliance hooks (freeze, forced Transfer, transfer checks) help meet regulatory expectations, something enterprises consistently demand in RWA infrastructures.

- Blocsys views ERC-7943 as the foundation for the next generation of tokenization platforms, bridging traditional finance (TradFi) with blockchain-native innovation.

- We recommend early adoption for issuers, exchanges, and asset-management platforms to position themselves for institutional markets and global liquidity.

Use-Cases & Scenarios

-

Real Estate Tokenization

Imagine a real estate company wants to tokenise a commercial building and offer fractional ownership to investors. Using ERC-7943 gives you:

freeze/unfreeze logic for escrowed investor funds or lock-up periods

forcedTransfer logic for asset reallocation or investor exit events

unified interface across different token classes and marketplaces. -

Corporate Debt or Equity Tokenization

A company issuing tokenized shares or bonds can embed the compliance control features of ERC-7943 ensuring transferability only to authorised users, freeze tokens when required (e.g., during a regulatory review), and have the fallback ability to enforce transfers if needed.

-

Commodities / Alternative Assets

Assets like art, commodities or exotic assets (carbon credits, royalty streams) often face fragmented token standards. By aligning to ERC-7943, you capture the minimal compliance layer common across these intervals and scale platform logic across asset types.

-

Platform & Secondary Markets

For tokenization platforms and secondary markets, supporting ERC-7943 means you can list assets regardless of underlying token type (fungible, non-fungible, semi-fungible) so long as they implement the standard’s interface simplifying listing logic and providing investor confidence via standard features.

Key Metrics & Trends to Watch

- Rate of tokenized RWA growth on-chain (currently ~US$28 billion and growing)

- Number of live tokenized assets adopting ERC-7943 interface

- Number of platforms, marketplaces or custodians officially supporting ERC-7943

- Regulatory signals around tokenized assets and compliance frameworks

- Interoperability and liquidity metrics for ERC-7943-compliant tokens vs. non-standard tokens

Conclusion

In a rapidly evolving ecosystem where tokenising real-world assets is becoming mainstream, ERC-7943 stands out as a key piece of infrastructure. For business software developers, asset issuers, investors and VCs, aligning with a universal, minimal, compliance-friendly standard is a strategic move not just technical.

Whether you are building the next tokenization platform, investing in high-growth infrastructure, or structuring asset issuance for global investors, ERC-7943 offers a framework that helps bridge the gap between traditional finance and blockchain innovation. The future is interoperable, regulated-ready and scalable and ERC-7943 may well be the foundation.

FAQ

Q: What does ERC stand for?

A: ERC stands for “Ethereum Request for Comment” , a type of standard for applications built on the Ethereum blockchain.

Q: Is ERC-7943 already “live”?

A: It is currently in the “Review” stage of the Ethereum Improvement Proposal process, meaning it is formally proposed and discussed but still subject to refinement.

Q: How does ERC-7943 differ from ERC-3643 or other RWA standards?

A: Unlike ERC-3643 which is more prescriptive (for example imposing on-chain identity and permissioning logic), ERC-7943 is intentionally minimal and agnostic focusing only on the core compliance/control interface and leaving implementation detail open.

Q: What kinds of assets can use ERC?

A: A wide variety: real estate, corporate debt/equity, commodities, art, alternative assets etc. Essentially any real-world asset that is tokenized and requires some level of regulatory or transfer control logic.

Q: Why should I care about ERC as an investor or VC?

A: Because early adoption of infrastructure standards often yields competitive advantage. Firms that build to ERC-7943 may scale faster, integrate better, attract more institutional capital, and present stronger exit potential.

Call to Action

If you’re ready to explore how your business can leverage ERC-7943 for tokenized asset infrastructure whether you’re issuing assets, or investing in the ecosystem, let’s talk. Reach out to our team of tokenization experts to:

- Assess your current architecture and readiness for ERC-7943 compliance

- Guide the building of modular compliance/control layers aligned with the standard

- Map market opportunities and investor-friendly structure for tokenized assets

- Take the step today and position your company or portfolio at the forefront of the tokenization frontier.

Let’s build the future of asset tokenization together.