Decentralized Finance (DeFi) is a blockchain-based financial system that enables peer-to-peer lending, borrowing, and trading without traditional intermediaries like banks. It replaces human gatekeepers with automated, self-executing code called smart contracts, creating a global, permissionless alternative to the current financial world. This guide is for founders, developers, and enterprise leaders in Web3, blockchain, and AI who need to understand the practical applications, risks, and opportunities in DeFi to build market-leading products. It provides a clear framework for navigating this complex ecosystem and making strategic decisions for the next 12-24 months.

What is the Core Mission of Decentralized Finance?

DeFi’s core mission is to rebuild the traditional financial system on an open, decentralized foundation. It aims to create a more transparent, efficient, and accessible financial infrastructure available 24/7. Unlike a bank, which operates with set hours and opaque processes, DeFi protocols are automated by code, making financial services universally accessible to anyone with an internet connection.

Instead of relying on institutions like banks or brokerages, DeFi runs on smart contracts—programs stored on a blockchain that automatically execute agreements when specific conditions are met. This removes the need for trusted third parties, making the entire system more efficient and equitable.

What are the Key Goals of the DeFi Movement?

The vision for DeFi is not just to improve the existing system but to fundamentally restructure it around a few core principles. This forward-looking approach is what differentiates it from incremental fintech innovation.

- Accessibility: To make financial services available to anyone, anywhere, regardless of geography or wealth.

- Transparency: To build a system where all transactions are publicly verifiable on the blockchain, fostering trust through auditable code.

- Efficiency: To reduce costs and accelerate settlement times by automating processes and eliminating intermediaries.

- Interoperability: To create a financial ecosystem where different applications and protocols can seamlessly connect and build upon each other, like "money Legos."

DeFi isn't just a new set of tools; it’s a complete rethinking of how financial services are designed and delivered. It shifts power from centralised institutions back to individual users, all driven by protocols governed by their communities.

To understand the scale of this financial system, it's worth reviewing the latest DeFi statistics. The data reveals the rapid capital inflow into these automated protocols. This decentralized philosophy also connects with other Web3 concepts, as seen in our guide on how the metaverse and blockchain are merging.

How Does DeFi Compare to Traditional Finance (TradFi)?

To grasp the fundamental shift, it helps to compare DeFi directly with the traditional finance (TradFi) world. The table below outlines the key differences from both an enterprise and startup perspective.

| Feature | Decentralized Finance (DeFi) | Traditional Finance (TradFi) |

|---|---|---|

| Accessibility | Global, permissionless, and open 24/7 | Restricted by geography, requires identity verification, and has set operating hours |

| Transparency | All transactions are public and verifiable on the blockchain | Operations are opaque; transaction data is private and controlled by the institution |

| Intermediaries | Smart contracts automate processes, removing the need for middlemen | Relies heavily on banks, brokers, and clearinghouses to facilitate transactions |

| Innovation | Open-source code allows for rapid, permissionless innovation | Slow and permissioned; new products require regulatory approval and internal development |

| Custody | Users maintain full control over their own assets in self-custody wallets | Assets are held and controlled by a third-party institution (custodian) |

While TradFi is built on trust in institutions, DeFi is built on trust in verifiable code. This creates a new paradigm for value transfer and asset management, offering both disruptive opportunities and new sets of risks for businesses to evaluate.

How Do DeFi Protocols Actually Work?

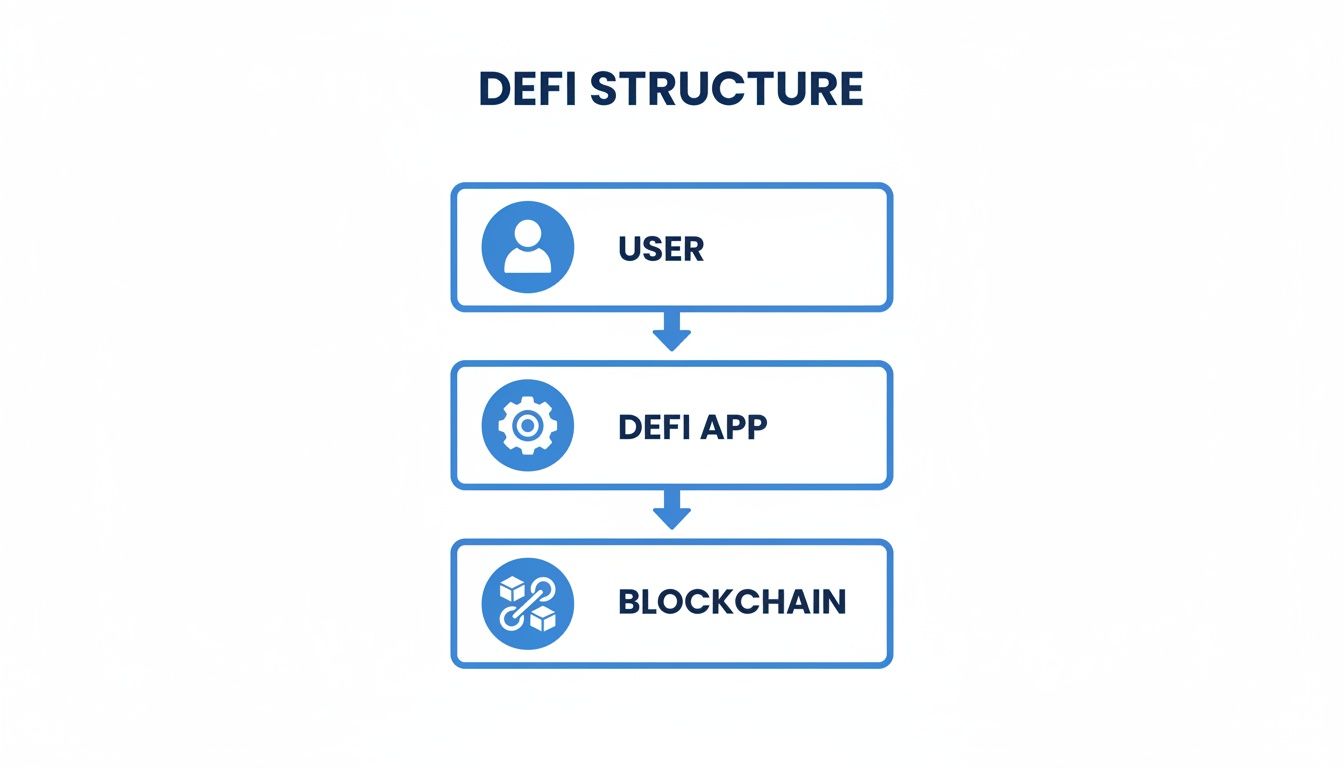

Understanding DeFi architecture is like understanding a technology stack. Every protocol is built with distinct layers, each depending on the one below it to create secure and automated financial services. This layered structure is what makes DeFi applications robust, interconnected, and "composable"—meaning they can be combined to create new products.

At the base is the settlement layer, the foundational blockchain itself (e.g., Layer 1 networks like Ethereum, Solana, or Avalanche). This is the core infrastructure providing security, decentralization, and the immutable public ledger where all transactions are permanently recorded.

Built on this foundation is the protocol layer, where smart contracts define the rules for specific financial activities. Protocols for lending (Aave) or trading (Uniswap) live here. As open-source frameworks, they allow developers to build new applications on top of them freely.

This vertical stack shows how users interact with DeFi applications built upon the foundational blockchain.

Finally, the application layer is the user-facing interface—the website or mobile app you interact with. It provides a simple gateway to the powerful protocols running underneath.

What are the Core Components Powering DeFi?

A few key technologies are essential for making DeFi protocols function automatically and without middlemen. Mastering these concepts is crucial for any leader making build-vs-buy decisions or evaluating platform risks.

A smart contract is the fundamental building block. It's a self-executing agreement with the terms of the deal written directly into code. Once specific conditions are met (e.g., payment received), the contract automatically executes the transaction without human intervention.

Another vital component is the liquidity pool. Instead of a traditional order book that matches individual buyers and sellers, many DeFi protocols use pools of assets locked in a smart contract. Users, known as liquidity providers, deposit funds into these pools and earn a share of the transaction fees in return, creating deep, accessible markets.

At its core, the DeFi architecture is a modular system. Each layer and component is designed to be combined and reconfigured, allowing for a rapid pace of development where new financial products can be assembled like Lego bricks.

How Does DeFi Connect to the Real World?

For DeFi to be truly useful, it must interact with data from outside its blockchain environment—like asset prices, weather data, or sports scores. This is where oracles come in. Oracles are secure data bridges that feed external, real-world information to smart contracts, enabling them to execute based on off-chain events.

Without oracles, smart contracts would be limited to on-chain data, severely restricting their utility for complex financial products like derivatives or insurance. For a deeper dive into this critical infrastructure, our guide on the power of Chainlink oracles in blockchain explains how this technology works in practice.

These components—smart contracts, liquidity pools, and oracles—work in concert. A user interacts with an application, which calls a function on a protocol's smart contract. That contract might then consult an oracle for data, execute a trade using a liquidity pool, and record the final transaction on the Layer 1 blockchain. The entire process is automated, transparent, and intermediary-free.

What are the High-Impact Use Cases for DeFi?

The true value of DeFi lies not just in its architecture but in the real-world problems it solves. Beyond early innovations like decentralized exchanges (DEXs) and lending platforms, the next wave of DeFi applications is focused on bridging the gap between digital and physical assets, creating entirely new markets. This is where enterprises and startups are finding significant opportunities.

The Rise of Real-World Asset Tokenization (RWA)

One of the most powerful trends is Real-World Asset (RWA) tokenization. This is the process of converting ownership rights of tangible or traditional financial assets into digital tokens on a blockchain. This makes previously illiquid assets divisible, tradable, and accessible on a global scale.

For example, a commercial property can be divided into thousands of digital tokens, allowing smaller investors to buy and sell shares as easily as trading crypto. This fractional ownership model opens up markets that were previously exclusive.

The opportunities span multiple sectors:

- Private Equity: Startups can tokenize equity, providing early investors with liquidity long before an IPO or acquisition.

- Fine Art and Collectibles: High-value assets can be fractionalized, making them accessible to a broader investor base.

- Commodities: Physical assets like gold can be represented by tokens, simplifying custody and transfer.

RWA tokenization is the bridge connecting traditional finance with the digital economy. It’s about unlocking trillions of dollars in illiquid assets and making them programmable, divisible, and globally accessible.

This trend is gaining significant momentum. In India, for instance, DeFi's growth is tied to a crypto ecosystem projected to reach USD 14.2 billion by 2034. While Bitcoin remains dominant, it's DeFi applications in trading (45.06%) and transactions (52.13%) driving the market. For Indian users, automated loans via smart contracts are a major advantage in a country where 40% of adults lack access to traditional banking.

Creating Transparent Markets for Carbon Credits

Another high-impact area for DeFi is climate finance, particularly carbon credits. The traditional carbon market is plagued by opacity, double-counting, and slow verification processes, which undermines its effectiveness in combating climate change.

DeFi offers a robust solution. By converting each carbon credit into a unique token on a public blockchain, it creates an immutable and transparent record. This ensures that once a credit is used (or "retired"), it cannot be resold, bringing much-needed integrity to the market.

Tokenized carbon credits can be integrated into DeFi marketplaces, unlocking further benefits:

- Improved Liquidity: Credits can be traded on DEXs, creating deeper, more accessible global markets.

- Transparent Pricing: Open market activity establishes a fair and transparent price for carbon.

- Automated Offsetting: Smart contracts can enable companies to automatically purchase and retire credits to offset their carbon footprint in real-time.

The table below outlines these innovative DeFi applications and their potential to reshape industries, offering a decision framework for leaders evaluating new ventures.

Emerging High-Impact DeFi Use Cases

| Use Case | Description | Business Opportunity | Relevant Technology |

|---|---|---|---|

| Real-World Asset (RWA) Tokenization | Converting ownership of physical assets like real estate or private equity into blockchain-based tokens. | Unlocks liquidity for traditionally illiquid markets, enables fractional ownership, and creates new investment products. | NFT Standards (ERC-721, ERC-1155), Oracles, Security Token Platforms |

| Tokenized Carbon Credits | Representing carbon offset credits as unique, verifiable tokens on a public blockchain. | Creates a transparent, liquid global market for carbon; enables automated corporate offsetting via smart contracts. | Public Blockchains (e.g., Ethereum, Polygon), NFTs, DeFi Marketplaces |

| Decentralized Insurance | Creating insurance products where premiums and claims are managed automatically by smart contracts. | Lowers overhead costs, increases transparency in claims processing, and allows for peer-to-peer risk pooling. | Smart Contracts, Oracles (for claim verification), Staking Mechanisms |

| Decentralized Identity (DID) | Giving users control over their own digital identity, stored securely on the blockchain. | Reduces fraud, simplifies KYC/AML processes, and enables new models for data monetization with user consent. | Verifiable Credentials, Self-Sovereign Identity (SSI) Frameworks, Zero-Knowledge Proofs |

These use cases demonstrate DeFi's evolution from crypto-native assets to solving tangible, real-world problems. For teams building in this space, developing a platform for RWA tokenization or a transparent exchange for carbon credits represents a massive opportunity. Our guide on creating a DeFi trading ecosystem and revolutionising finance provides further insights for those ready to build.

How to Navigate DeFi Risks and Regulations

While DeFi offers immense innovation, it is not without significant challenges. The core principles of automation, decentralization, and open access also introduce unique risks. For founders and technical leaders, understanding and mitigating these risks is not optional—it is essential for building resilient, long-lasting products.

Technical risks remain a primary concern. Smart contract vulnerabilities are a constant threat, where a single coding error can be exploited to drain millions from a protocol. Similarly, oracle manipulation, where attackers feed incorrect price data to a protocol, can trigger unfair liquidations.

Beyond code, there are inherent economic risks. Market volatility can cause cascading liquidations in lending protocols, while impermanent loss is a complex risk for liquidity providers on decentralized exchanges. These are not bugs but economic realities of automated financial systems that must be factored into product design and risk management frameworks.

What are the Common DeFi Security and Economic Risks?

Every major exploit provides critical lessons for builders. A deep understanding of attack vectors is necessary to implement robust security practices.

- Smart Contract Bugs: Flaws in the code's logic. A common exploit involves a re-entrancy attack, where an attacker repeatedly withdraws funds before the initial transaction is finalized, draining the protocol.

- Oracle Price Manipulation: Malicious actors manipulate an asset's price on one exchange to trigger adverse actions on another platform that relies on that price feed, such as forcing liquidations.

- Flash Loan Attacks: Attackers borrow large amounts of capital with zero collateral (a "flash loan"), use it to manipulate market prices, execute an exploit, and repay the loan within a single transaction, extracting significant profit.

Building a secure DeFi product isn't just about writing clean code. It's about anticipating how clever, well-funded actors will try to break your system. Security has to be a continuous cycle of auditing, monitoring, and adapting—not a one-time checklist.

How is the Global Regulatory Environment Evolving?

The regulatory landscape for DeFi is a complex and evolving puzzle. Regulators worldwide are grappling with how to apply existing financial laws to this new decentralized paradigm, focusing on Anti-Money Laundering (AML), Know Your Customer (KYC), and the classification of digital assets.

A firm grasp of understanding securities regulation is vital, as many tokens and protocols can inadvertently fall into this category. Projects must consider their legal obligations from day one to avoid future complications.

This uncertainty is particularly relevant in high-growth markets. India's crypto market, heavily influenced by DeFi, is projected to reach USD 11.07 billion by 2031, driven by a young generation seeking alternatives to the 4-6% returns from traditional banks. However, regulatory headwinds, such as the RBI's cautious stance and a 30% tax on crypto gains, create significant hurdles.

For any company building in DeFi, this means designing for compliance from the outset. This could involve implementing identity verification layers for institutional clients or building robust reporting tools. The goal is to create products that can thrive in a regulated future, not just survive in the permissionless present.

How to Build Your Own DeFi Product

Bringing a DeFi product from concept to reality involves more than just writing code; it requires building a secure, scalable, and compliant financial service. The journey is marked by critical decisions at every stage, from selecting a foundational blockchain to designing a user-friendly interface.

The first major decision is choosing the right blockchain. This choice dictates your product's speed, transaction costs, and security model. An application requiring high throughput and low fees might be best suited for a network like Solana or Polygon. In contrast, a protocol where maximum decentralization and security are non-negotiable might choose Ethereum as its foundation.

What is the Smart Contract Development Lifecycle?

With a blockchain selected, the next step is building the core of your product: the smart contracts. This process demands absolute precision to avoid common exploits.

- Design and Architecture: Define the logic, core functions, and permission levels. A clear architecture is the foundation for secure code.

- Secure Coding Practices: Adhere to battle-tested standards, such as the checks-effects-interactions pattern, to prevent vulnerabilities like re-entrancy attacks.

- Rigorous Testing: Develop a comprehensive test suite that covers all possible scenarios, especially edge cases and potential attack vectors.

- Independent Audits: Engage multiple reputable third-party firms for professional security audits before deploying to the mainnet. This is a non-negotiable step.

A disciplined approach is critical. The history of DeFi is filled with projects that failed due to cutting corners on security, resulting in catastrophic losses for their users.

Should You Build from Scratch or Use a White-Label Solution?

A key strategic decision is whether to build your entire platform from the ground up or leverage a white-label solution. Each path has distinct trade-offs that must be weighed against your team's goals, resources, and timeline.

Building from scratch offers complete customization but requires significant time, deep technical expertise, and a larger upfront investment. In contrast, a white-label solution can dramatically accelerate time-to-market and reduce initial development costs by providing a pre-built, battle-tested foundation. This is an ideal route for teams focused on business growth rather than reinventing core infrastructure.

For many teams, especially in a fast-moving market, the strategic advantage of launching a secure, audited platform in days or weeks far outweighs the benefits of a lengthy custom build. It shifts the focus from engineering problems to capturing market opportunity.

This is particularly true as institutional capital enters the DeFi space. The rise of institutional players in India mirrors global trends, with institutions projected to grow at a 32.55% CAGR through 2031. This has already led to DeFi platforms in India attracting USD 1.2 billion in deposits from high-net-worth individuals. You can find more insights on the DeFi market's evolution from sources like Grand View Research. This influx of serious capital demands robust, secure, and rapidly deployable infrastructure.

How Blocsys Can Accelerate Your DeFi Journey

This guide outlines the immense opportunities in DeFi while highlighting the significant hurdles—security, compliance, and scale. Navigating this landscape requires a partner with deep, end-to-end expertise. Blocsys provides a clear, secure path for organizations ready to build, launch, and grow their DeFi initiatives, transforming complex ideas into market-ready products. Our approach is founded on security and practical execution, de-risking your project from day one.

End-to-End Development and Strategic Partnership

At Blocsys, we are more than just developers; we are strategic partners invested in your long-term success. We understand that a winning DeFi product requires a series of critical decisions, from initial architecture to go-to-market strategy. Our team provides expert guidance at every stage, ensuring you build a product that is not only technically sound but also positioned to capture market opportunity.

Our expertise covers the entire DeFi stack, offering a single, reliable point of contact for all your development needs.

- Smart Contract Auditing: We conduct rigorous audits to identify and fix vulnerabilities, ensuring your code is secure before it handles user funds.

- Multi-Chain Architecture: We design and build robust, scalable infrastructure that operates seamlessly across multiple blockchains, future-proofing your application.

- Bespoke Platform Development: We specialize in building custom platforms for high-growth sectors, including Real-World Asset (RWA) tokenization and transparent carbon credit marketplaces.

Blocsys doesn’t just build what you ask for; we partner with you to build what the market actually needs. Our focus is on creating secure, compliant, and scalable DeFi solutions that deliver tangible business outcomes and stand the test of time.

Accelerating Your Time-to-Market

In the DeFi space, speed is a critical advantage. We help you launch faster and smarter without compromising on security or quality. Our white-label solutions provide a battle-tested foundation for platforms like exchanges and RWA tokenization, enabling you to move from concept to launch in a fraction of the time required for a custom build.

This accelerated timeline frees your team to focus on core business activities—user acquisition, community building, and strategic partnerships—instead of complex engineering challenges. We enhance our development process with the latest technology, integrating AI agents into our workflows and the products we build to automate processes, generate data-driven insights, and deliver a smarter user experience.

Choosing Blocsys means choosing a partner committed to your vision. We bring the technical firepower, strategic insight, and unwavering support needed to build the next generation of decentralized finance.

Frequently Asked Questions About DeFi (FAQ)

This section provides concise answers to common questions about Decentralized Finance, designed for clarity and quick understanding.

What Is The Difference Between DeFi and Crypto?

Cryptocurrencies like Bitcoin are digital assets used as money or a store of value. DeFi (Decentralized Finance) is the ecosystem of financial applications built using those cryptocurrencies. In short, crypto is the asset, while DeFi is the set of services—like lending, borrowing, and trading—that use the asset without traditional banks.

Is DeFi Safe To Use?

DeFi's safety depends on the security of its smart contracts. While the underlying blockchain technology is generally secure, vulnerabilities in a protocol's code can be exploited, leading to financial loss. To mitigate risk, use platforms that have undergone multiple independent security audits and have a long-standing, reputable track record.

How Do You Get Started With DeFi?

Getting started in DeFi involves three key steps:

- Get a Self-Custody Wallet: Set up a wallet where you control the private keys, such as MetaMask for browsers or Trust Wallet for mobile.

- Acquire Cryptocurrency: Purchase crypto on an exchange and transfer it to your self-custody wallet.

- Connect to a dApp: Visit a DeFi application (dApp) like Uniswap or Aave and connect your wallet to begin interacting with its services.

Always start with a small amount and research any platform thoroughly before depositing significant funds.

What Is Total Value Locked (TVL) In DeFi?

Total Value Locked (TVL) is a key metric representing the total monetary value of all assets deposited in a specific DeFi protocol's smart contracts. It is used to measure a protocol's market share, liquidity, and user trust. A higher TVL generally indicates greater adoption and confidence in the platform.

Navigating the complexities of DeFi requires a partner with deep technical expertise and strategic insight. At Blocsys Technologies PVT LTD, we specialise in building secure, scalable, and compliant DeFi solutions, from RWA tokenisation platforms to custom trading ecosystems. Let us help you accelerate your journey from idea to execution.

Connect with our experts to discuss your DeFi project today.